I trust Fraser - he's good - but what he identified was such a howler that I wanted to check and, having a bit more time, dig a layer deeper. Fraser was right - if anything it's even worse than he thought.

So here we go, with references to the Growth Commission report indicated [thus]...

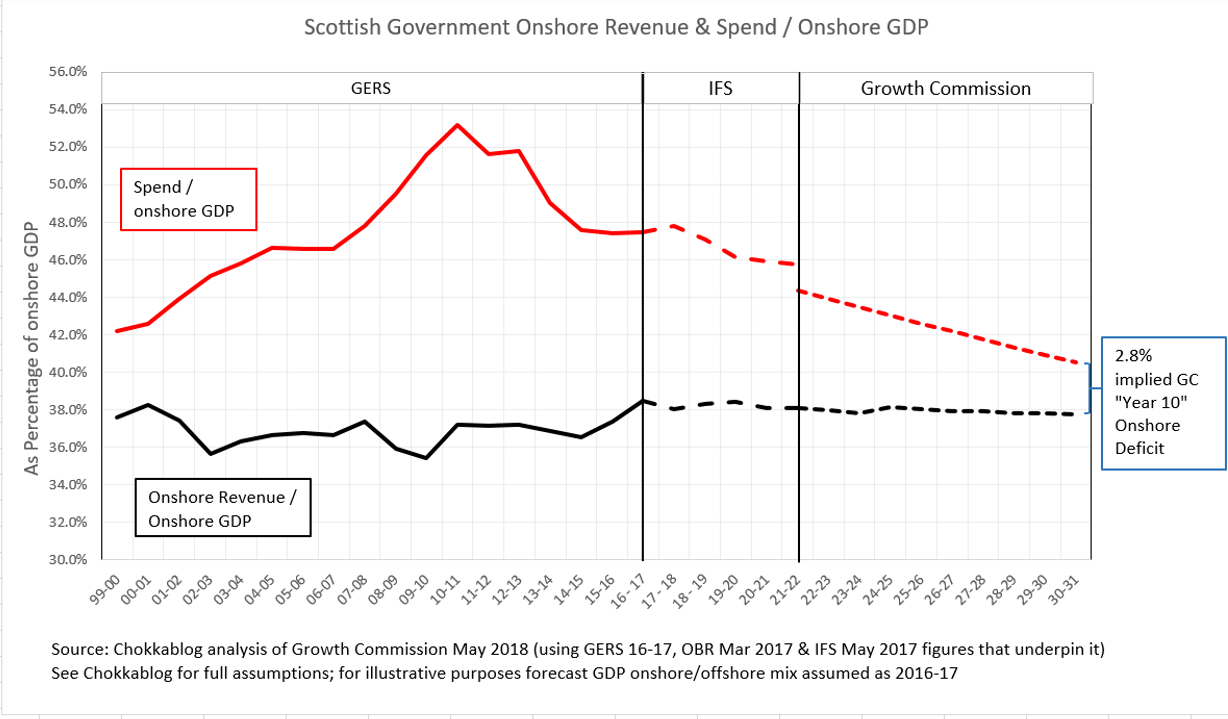

The largest claimed saving is for spending reductions compared to allocated UK government spending of 0.8% of GDP [B4.67]. The justification for this figure in the report is unclear and based on demonstrably flawed assumptions.

The report suggests [B4.57] a comprehensive 2 year review to analyse “where savings could be made where costs need not be replicated”.

The report then [B4.58] seems to declare the result of this proposed analysis by stating “This analysis shows an improvement in the public finances of around £1 billion [...] the equivalent of 0.8% of GDP”

An immediate concern here is that £1 billion is in fact 0.67% of 2016-17 onshore GDP1, but the figure of 0.8% is the one the report goes on to use.

A bigger issue is the way in which the £1 billion figure is justified. It is explained [B4.58] as being made up of savings of £0.4bn and revenue benefits of £0.6bn.

The asserted potential saving of £0.4bn from costs “that will no longer be required” is supported by a few examples that total just £170m2. Even the examples given are not well justified3 and include a sweeping “more than £100m for Whitehall running costs that will not need to be duplicated in Scotland”.

The revenue benefit of £0.6bn is explained as being associated with £2.4bn of “spending that is allocated to Scotland but takes place elsewhere”. Not only does this £2.4bn include costs that the report has just assumed will be saved (and so can’t be transferred), the assertion that all of this £2.4bn4 of spending currently allocated to Scotland takes place outside of Scotland is simply and very materially wrong.

To illustrate: the £2.4bn includes £484m [Table 4-2] of ‘Public & Common Services’ costs. In 2015-16 the equivalent figure was £467m, a figure we can break down in detail by using the GERS expenditure database.

This shows us that not only does this figure include all of the costs that the Growth Commission has explicitly assumed will be saved5, but that it includes spend which already takes place in Scotland.

The figure includes, for example, £234m6 of current expenditure on HM Revenue & Customs, this being Scotland’s 8.3% population share of the total UK figure7. In fact we know that 12% of HMRC headcount is currently based in Scotland8, so it is simply wrong to assume that Scotland would benefit from transferring this expenditure to Scotland.

In fact, in this specific example it seems likely that Scotland would see economic harm as a result of independence, as a greater share of HMRC employees are in Scotland than Scotland’s population share9.

This reveals another flaw in the analysis: not only are the Commission fundamentally wrong in assuming that no central spending allocated to Scotland takes place in Scotland, they don't consider the mirroring effect which is that there will be costs spent in Scotland that are currently allocated to the rest of the UK. What the true net effect of this is would require deeper analysis - but we can be sure that the Growth Commission's analysis is simply and very significantly wrong.

So the assumed saving of 0.8% of GDP from spending reductions (compared to GERS allocated UK government spending) falls apart when tested and is clearly heavily overstated.

Two years they spent writing this report.

Two years.

Notes:

1. Using 2016-17 GERS figure of £150,025m for onshore GDP (£1bn is 0.63% of the £159,389m total GDP figure)

2. [B4.58] £50m associated with running costs of the House of Commons & House of Lords, £20m for the Scotland Office and “more than £100m for Whitehall Department running costs”

3. According to the 2015-16 GERS expenditure database, a total of just £36m is allocated for House of Commons and House of Lords; the Scotland Office figure is £23m

4. This figure appears to be made up of total allocated spending [Table 4-2] of £4.7bn less international affairs (£0.8), all economic affairs (£1.0bn), and we presume accounting adjustments and EU transactions (£0.5m)

5. House of Lords & House of Commons (£36m), Scotland Office (£23m) and various “Whitehall Costs” including Cabinet Office, DfID, HMRC, HMT etc.

6. This £234m is categorised as “non-identifiable expenditure” in the database, but this does not mean the expenditure takes place outside Scotland. We suspect this may have been the cause of the Commission’s misunderstanding

7. £2,838m, defined in the GERS expenditure database as: HMR041-S041A003-UK-TES_CUR-Non-ID-CG-SUB010100

8. Institute for Government, “Governing after the Referendum” - Figure 2, page 24

9. Of course to answer this question properly we’d need to know the share of spend, not just share of employment – but the point at issue here is that the Growth Commission’s assumptions are clearly and materially flawed.