The Spin is pretty simple: because the SRIT has to be applied to all tax bands equally (true) it would unfairly hit the poorest hardest (untrue).

Here's Swinney (our Finance Minister) to the Scottish Parliament

"By its nature, exercising that power would have a disproportionate effect on the amount of tax paid by the taxpayers on the lowest incomes."... and being interviewed by the BBC

"It would have in fact been about double the effect on the taxable income of individuals at the lower income thresholds rather than people at higher income thresholds"This is from the Scottish Parliament Information Committee (SPICe). Coming from the politically independent government body that is meant to inform MSP's I find this truly shocking - if you don't know why, read on

Here's SNP MSP Joan McAlpine on Twitter

I could find plenty of other examples but anybody with ears knows that variations on this theme are being hammered into the Scottish consciousness: the SNP aren't using SRIT powers because they would hurt the poorest most.

This (rather than governing) is what the SNP do best. It's a kind of mass Neural Linguistic Programming; they select a few simple statements and relentlessly repeat them until they are received as wisdom by their trusting supporters. All political parties do this to some degree of course, but the lack of scrutiny applied to the SNP and their sheer brass-neck sets them apart. The intelligentsia may expose their soundbites as being deeply misleading or (as in this case) simply wrong, but that doesn't matter. Their supporters are well trained to ignore dissenting voices.

We could assemble a greatest hits list: the ones that intentionally mislead by ignoring our higher public spending ("we generate higher GDP per capita", "we send more tax per head") or the ones that are - by any reasonable analysis - downright wrong ("oil is just a bonus", "we'd have been £8bn better off", "our oil forecasts were in line with the market at the time"). To the second list we can now add "using SRIT would hurt the poorest most"

So why is this assertion so misleading?

As I explained in my last blog (Swinney: Confused or Aiming to Confuse), the suggestion that a flat increase to all tax rates (which is all that SRIT currently allows) hurts the poorest most plays on a simple intuitive misperception: people think the poorest pay 20% tax and the richest 40%, so 1/20 is twice as bad as 1/40. Their are a couple of problems with this, the biggest being that we only pay tax above a threshold (the Personal Allowance) which means that a higher proportion of higher earners' income is taxed1.

In my last blog I explained (using rounded figures) how an additional 1% SRIT would mean - because the first £10k of income (the Personal Allowance) is not taxed - someone earning £20k would pay £100 more tax but someone on £40k would pay £300 more tax .

The wider point here is that this additional tax money raised could be used to alleviate the impacts of "Westminster's austerity policies". The additional money raised could be recycled into public spending in a way that defends our essential public services and protects the poorest in society. A simple person might think that the SNP - having campaigned as the "anti-austerity" party - would lose all credibility if they failed to take this opportunity to put their words into action.

But back to the narrow "proportionality" argument. I've had time to refine the analysis a little so that it includes employees' National Insurance Contributions. This means we can see the impact on take-home pay (which is surely the key measure here);

It's a detailed table but the key row is the one showing "impact on take-home pay" (the first column is for somebody working full time on the National Minimum wage). Taking the first four columns, all figures are full annual impact:

- Earning £14k: pay £34 more tax, a 0.3% reduction in take-home pay

- Earning £20k: pay £94 more tax, a 0.6% reduction in take-home pay

- Earning £40k: pay £294 more tax, a 1.0% reduction in take-home pay

- Earning £60k: pay £494 more tax, a 1.2% reduction in take-home pay

It is undeniable that the poor are affected, but to suggest (as Swinney has) that SRIT would have a "disproportionate effect on the amount of tax paid by the taxpayers on the lowest income" or "double the effect on the taxable income of individuals at the lower income thresholds rather than people at higher income thresholds" is at best intentionally misleading and at worst (as I would argue) it is frankly wrong. The last row in the table above is how the SNP attempt to justify the statement: you be the judge.

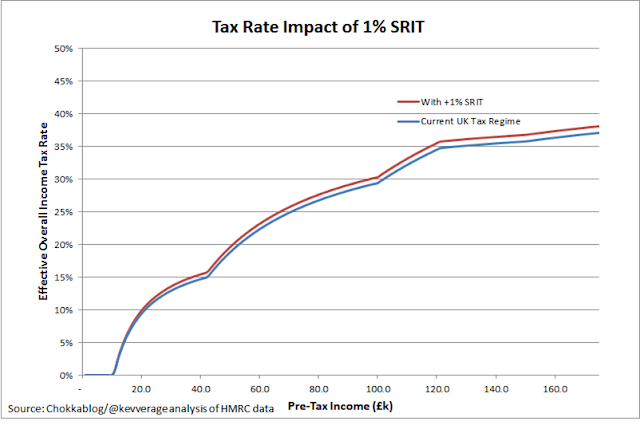

Now regular readers of Chokkablog will know I do like a graph and this data screams out to be graphically presented. Just two graphs should do it.

To help us understand how effective tax rates vary by income level (factoring in the impact of the Personal Allowance) and how an additional 1% SRIT would impact that;

Note how the red line (the additional 1% SRIT line) diverges from the blue line (current tax policies) - the effect is magnified for higher earners.

As an aside: the first curved section of the line is of course tending towards 20% (the maximum tax you would pay if there were no higher bands). Similarly the second tends towards 40% (the proportion of income taxed at less than that rate declines as you head further right). The change in profile between £100k and £120k is simply because the personal allowance is phased out for higher rate tax payers over this range - effectively accelerating us towards the 40%. The final additional rate kicks in above £150k, sending us on a line which is asymptotic to 45%. If you earn £1m you pay 43.6% tax (somebody asked).

As an aside: the first curved section of the line is of course tending towards 20% (the maximum tax you would pay if there were no higher bands). Similarly the second tends towards 40% (the proportion of income taxed at less than that rate declines as you head further right). The change in profile between £100k and £120k is simply because the personal allowance is phased out for higher rate tax payers over this range - effectively accelerating us towards the 40%. The final additional rate kicks in above £150k, sending us on a line which is asymptotic to 45%. If you earn £1m you pay 43.6% tax (somebody asked).

Finally, let's look at the measure that I would argue is the best single measure of the proportionate impact of SRIT: what impact a 1% increase has on the take home pay of people on different salary levels:

Now: you can argue that the incremental pound matters more to a lower earner and that existing SRIT powers don't allow us to avoid impacting all tax payers. They are valid points. But when Swinney brazenly asserts that using SRIT powers would "have a disproportionate effect on the amount of tax paid by the taxpayers on the lowest incomes" or would have "about double the effect on the taxable income of individuals at the lower income thresholds rather than people at higher income thresholds" he is engaging in a conscious deceit.

I'm not alone here (for example this We Need to Talk About Tax piece by Graeme Cowie covers similar ground), The good news for the SNP is of course that hardly anybody reads blogs like this - they won't be losing any sleep.

For what it's worth: here's my attempt at a shareable single graphic summary:

Or if we'd rather keep it in his "amount of tax paid" terms;

1. The other problem is that taking percentages of percentages is nearly always a misleading thing to do. It's been (correctly) pointed out in the comments that "the percentage increase in tax bill" logic allows the statement to be justified - the lower income tax bills goes up by 5%, declining to 2.8% at £150k. This is true and I covered it in the previous blog - but as I highlight, the impact on take-home pay (or total effective tax rate) is greater the higher the income bands because a higher proportion of their income is taxed. I'm comfortable this is what matters, is the only reasonable way to interpret the figures