Twitter has been embraced by many of our leading politicians (in Scotland at least). The obvious advantage of Twitter is that it disintermediates; messages are not parsed by a sometimes unhelpful media but instead pass uneditted from the keypad of the politician to the screen of the reader.

For those who are smart enough not to outsource their account management to a press officer, Twitter offers a wonderful opportunity to project their true personalities. Women in Scottish politics seem to be particularly adept at this. During last year's Australian Open, our three most prominent female MSPs treated us to this rather marvellous exchange

@RuthDavidsonMSP I'm sure we could come to some arrangement - @kdugdalemsp?

— Nicola Sturgeon (@NicolaSturgeon) January 29, 2015

@RuthDavidsonMSP @NicolaSturgeon yes, there in a minute, looking for the Pimms

— Kezia Dugdale (@kdugdalemsp) January 29, 2015

Adding weight to the "female politicians are better at this than men" thesis is the recent arrival on Twitter of Johann Lamont (until recently leader of Scottish Labour's opposition). She has a fine line in self-deprecating wit, as she showed during last night's Eurovision

@NicolaSturgeon Oops. Don't tell me I am in the minority. Again.

— Johann Lamont (@JohannLamont) May 23, 2015

I don't know why this should be the case, but it's hard to imagine equivalent exchanges between prominent male politicians. More's the pity.But of course it's not just about prominent figures taking the opportunity to demonstrate their character and humour. It's possible - in theory at least - to use social media as a way of engaging in substantive debate. It's true that Twitter's 140 character limit forces aphoristic brevity, but in the era of sound-bite politics and short attention spans that's arguably no bad thing. And of course for those keen to delve a little deeper both Twitter and Facebook can act as gateways through to more detailed expositions - the chances are you're reading this blog as the result of a Tweet or a Facebook posting.

The performance of politicians when it comes to using Twitter as a forum to engage (as opposed to project) is - in my experience - patchy at best. I've blogged before about the exchanges I've had with SNP MP's George Kerevan, Stewart Stevenson and Michelle Thomson. I'm maybe not best placed to judge, but I don't think any of their reputations were burnished by our interactions. The pattern is usually the same: they say something that's demonstrably untrue or at the very least misleading; I politely ask for clarification; they respond assuming they can bluff their way through; I demonstrate I know what I'm talking about; they go quiet. Of course Kerevan and Thomson were both elected to Westminster with landslide margins, so it's clear their interactions with me didn't cause them any lasting harm.

At least if politicans are on Twitter they can be swiftly and directly upbraided when they spout nonsense. In the past many of us have shouted at the television in frustration and achieved nothing more than startling our pets; now we can at least share our irritation with a wider audience.

Take this recent brief exchange with Angus MacNeil MP (after he attempted to misrepresent a piece of NIESR research).

@AngusMacNeilSNP

Do you have a link for that - would be interesting to unpick those numbers.

Thanks

— Kevin Hague (@kevverage) May 20, 2015

He responded by blocking me immediately, which seemed a little harsh. But when I shared that fact it got widely retweeted. As of today my Twitter analytics tells me the Tweet below has been viewed by over 70,000 people.

Democracy, Scotland 2015 pic.twitter.com/wNnvuUdfaX

— Kevin Hague (@kevverage) May 20, 2015

I'm sure Angus won't be losing any sleep over this, but it is at least more satisfying for me than an impotent rant at the TV. And my dog's slumber was undisturbed; this has to be seen as progress.Aa an aside: Angus Armstrong (a Director of NIESR) did respond to him pointing out that the NIESR hadn't implied what Mr MacNeil suggested. I don't know if Angus blocked him or not.

@AngusMacNeilSNP No-one @NIESRorg has made this claim. Austerity may have led to loss of UK output but this implies nothing about FFA #bbcsp

— Angus Armstrong (@angusarmstrong8) May 20, 2015

So far so good. These examples all show how social media generally and Twitter specifically can, in a small way, add to the quality of political debate.

There's a darker side to all of this of course. I have been asked few times by journalists about the abuse I receive online. My response is generally a shrug. What can sometimes seem like a lot of noise is usually no more than a handful of people. In the context of the volume of voices on Twitter it's frankly irrelevant and it's easy enough to block and move on.

But there is something about the burgeoning role of social media that bothers me far more than the trolls, cybernats and other online abusers: social media is an extremely powerful tool for spreading misinformation.

There has been plenty written about the role of social media in propogating conspiracy theories. Wikipedia suggests that between 6% and 20% of Americans and possibly 28% of russians believe the manned moon landings were fake.

The potential for ludicrous theories or beliefs to gain traction online has not gone unnoticed by the smarter political campaigners and, in my experience, the SNP have been particulary adept at exploiting this.

Let's take one simple example that my Twitter timeline is consistently plagued by: the suggestion that the official Governement Expenditure and Revenue Statistics (GERS) are totally flawed (and so can be safely ignored if they demonstrate what some of us would suggest are unfortunate truths).

The most common accusations are that they miss huge chunks of revenue because they fail to include export duty on whisky and VAT receipts that are recorded at company headquarters in London. There is no such thing as export Duty on Whisky and the VAT receipts in GERS are estimated, correctly, based on point of consumption. I've covered this in detail many times on this blog - the extract below is from my post on "How Scotland's Economy Contributes to the UK" if you need more convincing

The GERS figures are created by the Scottish Government and underpinned the economic case for Independence - so it is fair to assume that if there is any bias it would be to skew the picture in Scotland's favour.

HMRC produce their own figures (Table 4 in this HMRC Document shows methodological differences between HMRC and the Scottish Government) and pages 38 and 39 of GERS show that the differences between HMRC and GERS estimates are are in fact very small.

GERS estimate Scottish Tax revenues in 2013-14 to be 0.36%(£181m) higher than HMRC. The likes of Business for Scotland and Wings Over Scotland have made startlingly misinformed statements about VAT and Alcohol Duty that have led some people to doubt the validity of these figures.

If BfS and Wings were right it would be a terrifying indictment of the Scottish Government and the official Yes campaign's competence - but of course they are not right; the figures are sound.

References to VAT being "paid at companies' headquarters" and Scotland not getting attributed "Alcohol Duty at point of export" demonstrate a fundamental misunderstanding of how these taxes work and how they are attributed in GERS. These are consumption taxes and GERS estimates Scotland's share of these based on consumption data. There is no such thing as "Export Duty" on whisky (in fact you get Export Duty Relief); for the same reason we get to keep tobacco Duty despite not producing cigarettes. A 2 minute search of the official GERS Method Statement is enough to dispel these myths.

But browse the comments section of my blog or engage in any GERS numbers based debate on Twitter and you'll see that these untruths are well established in the minds of many voters. How do they become so firmly rooted?

You won't (as far as I'm aware) hear any elected MSP suggesting the GERS figures are fundamentally flawed - they would look ridiculous if they did. But you don't have to look too far to see how this misinformation has been seeded online by the SNP's cheerleaders.

This post from the awful "Wings Over Scotland" is still available for all to see - amongst a lot of nonsense it includes the following paragraph

So we can see how these falsehoods (and many others) are shamelessly seeded by the SNP's influential social media taskforce. Of course our social media savvy SNP MPs and MSPs do nothing to disabuse their followers of the resulting false perceptions.

This stuff takes root. That Wings Over Scotland post was made in November 2013 and is still consistently cited as "proof" that the GERS figures are wrong. Of course the beauty of a blog, of online materials generally, is that if errors are pointed out it's the work of moments to correct them. So either the blog's author (the odious* "Reverend" Stuart Campbell) doesn't realise his mistake or he's happy to perpetuate what he knows to be an untruth. There are plenty more examples I could cite; I'm pretty sure he knows precisely what he's doing.

This to me is far more concerning than people like me receiving a few snide, snarky and occasionally downright nasty tweets.

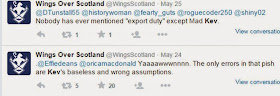

Incredibly there has been a storm of people on Twitter (including the Rev himself) defending these ludicrous claims that he's published.

Firstly let's be absolutely clear: GERS does not miss out Scottish Revenues - the whole point of GERS is to hypothecate a stand-alone Scotland's finances and it's created by the Scottish Government and was the foundation of the White Paper.

On the specific excise duty point - the 2008 GERS incudes this helpful summary which I quote in its entirety here (highlighting mine obviously):

If in doubt, here's the Scotch Whisky Association on the topic

You might think the Reverend would have the sense to back down gracefully - lol.

This is how he's responded (do read through to the denouement)

The abuse aside*, it's frankly hilarious that he finishes by attempting to reinforce the belief he's actively propagated - namely that GERS misses a load of revenue that should rightfully be attributed to Scotland.

He plays semantics around "export duty" not being mentioned - I quoted him verbatim in my original post and my timeline is littered with people using the phrase "export duty" and linking back to his article as "proof".

In case anybody is won over by his "export duty wasn't mentioned point", this is the end of the Wings article that I was quoting from (if you can stomach reading the whole article it makes the same erroneous point about VAT reporting);

So Wings tells his followers that GERS is missing a figure that "would likely" be £10bn+.

He really should be on the phone to the person who takes responsibility for the GERS figures - the Scottish Government's Chief Statistician.

* for those who question my use of the term "odious" I refer you to the above and his timeline in general

While writing the above Addendum I emailed a highly respected industry expert who - given the abuse I've been receiving - understandably wishes to remain anonymous. On this one I'm afraid you'll have to take my word for ot that this chap knows his stuff. He confirms that my understanding is correct and offered the following simple rebuttal to the quoted extract from the Wings article;

You won't (as far as I'm aware) hear any elected MSP suggesting the GERS figures are fundamentally flawed - they would look ridiculous if they did. But you don't have to look too far to see how this misinformation has been seeded online by the SNP's cheerleaders.

This post from the awful "Wings Over Scotland" is still available for all to see - amongst a lot of nonsense it includes the following paragraph

There are other ways in which Scottish revenues are invisible in the official statistics. Much of the alcohol duty paid by our whisky industry is not counted as revenue from Scotland. Alcohol produced in the UK which is exported abroad becomes subject to UK alcohol duty at the point of export, and a large proportion of Scotland’s multibillion whisky exports gets shipped out from ports in England. The UK Treasury counts the duty levied on this whisky as income from the tax region in which the port is situatedThis is of course simply, demonstrably and unequivocally complete rubbish. Funnily enough the same paragraph appears in a paper from the similarly ludicrous Business for Scotland. They didn't even bother rewording it - it's a direct cut & paste job. That seems to be how the SNP mouthpieces work.

So we can see how these falsehoods (and many others) are shamelessly seeded by the SNP's influential social media taskforce. Of course our social media savvy SNP MPs and MSPs do nothing to disabuse their followers of the resulting false perceptions.

This stuff takes root. That Wings Over Scotland post was made in November 2013 and is still consistently cited as "proof" that the GERS figures are wrong. Of course the beauty of a blog, of online materials generally, is that if errors are pointed out it's the work of moments to correct them. So either the blog's author (the odious* "Reverend" Stuart Campbell) doesn't realise his mistake or he's happy to perpetuate what he knows to be an untruth. There are plenty more examples I could cite; I'm pretty sure he knows precisely what he's doing.

This to me is far more concerning than people like me receiving a few snide, snarky and occasionally downright nasty tweets.

ADDENDUM

Incredibly there has been a storm of people on Twitter (including the Rev himself) defending these ludicrous claims that he's published.

Firstly let's be absolutely clear: GERS does not miss out Scottish Revenues - the whole point of GERS is to hypothecate a stand-alone Scotland's finances and it's created by the Scottish Government and was the foundation of the White Paper.

On the specific excise duty point - the 2008 GERS incudes this helpful summary which I quote in its entirety here (highlighting mine obviously):

Value Added Tax ( VAT) and excise duties are the principal elements of indirect taxation ( i.e. taxes on products) in the UK.

VAT is charged on the final consumption of certain goods and services and is levied at 17.5% of the purchase price, though a reduced rate of 5% is levied on some items.

Alcohol excise duty is a flat-rate duty on alcoholic beverages while tobacco duty is a combination of flat rate duty and an ad valorem tax charged on cigarettes, cigars and loose tobacco. Any revisions to VAT and excise duties are announced during UK Budget and Pre-Budget ( PBR) reports.

Two alternative apportionment methodologies can be applied to VAT and excise duties.

In GERS, VAT and excise duty estimates for Scotland are based on the consumption approach.

- Consumption based approach - apportioning VAT and excise duty to the region in which the good was consumed.

- Production based approach - apportioning VAT and excise duty to the region in which the good was produced.

This is appropriate as the burden of the duty is borne by the final consumer rather than the producer. This is considered best practice as within a system of regional fiscal accounts, the VAT liability 'sticks' when the item is purchased by the final consumer. The location of production is of no relevance.

Tobacco and alcohol duties are only collected if the product is consumed in the UK. If the product is exported, the producer receives export relief. For example, while duty is levied on Scotch Whisky when it leaves a bonded warehouse, in reality it is only collected if the whisky is consumed in the UK. Consequently, the ultimate payer of the duty is the UK consumer of the product.

Therefore, GERS estimates duty collected from Scotch Whisky based upon the level of whisky consumption in Scotland, even though Scotch Whisky is only produced in Scotland. Similarly, the estimate of tobacco duty collected in Scotland is based upon the level of consumption of tobacco products in Scotland, even though most tobacco goods are produced outside Scotland.So his article that talks about missing Scottish revenues because of excise duties levied at English ports is just wrong.

If in doubt, here's the Scotch Whisky Association on the topic

@scotspoond We have no reason to query the HMRC figures.

— Scotch Whisky Assoc. (@ScotchWhiskySWA) April 15, 2015

This is how he's responded (do read through to the denouement)

The abuse aside*, it's frankly hilarious that he finishes by attempting to reinforce the belief he's actively propagated - namely that GERS misses a load of revenue that should rightfully be attributed to Scotland.

He plays semantics around "export duty" not being mentioned - I quoted him verbatim in my original post and my timeline is littered with people using the phrase "export duty" and linking back to his article as "proof".

In case anybody is won over by his "export duty wasn't mentioned point", this is the end of the Wings article that I was quoting from (if you can stomach reading the whole article it makes the same erroneous point about VAT reporting);

Billions of pounds of Scottish revenue is magicked away in the official statistics, and doesn’t count as Scottish revenue. It masquerades as revenue from other parts of the UK, most commonly as revenue from London. In total, the extra revenues which don’t currently figure in the GERS stats, but would accrue to an independent Scottish Treasury, would likely be larger than the entire annual income from the North Sea.This article was published in November 2013 - at that time the most recent annual income from the North Sea was £9.7bn.

So Wings tells his followers that GERS is missing a figure that "would likely" be £10bn+.

He really should be on the phone to the person who takes responsibility for the GERS figures - the Scottish Government's Chief Statistician.

* for those who question my use of the term "odious" I refer you to the above and his timeline in general

ADDENDUM 2

While writing the above Addendum I emailed a highly respected industry expert who - given the abuse I've been receiving - understandably wishes to remain anonymous. On this one I'm afraid you'll have to take my word for ot that this chap knows his stuff. He confirms that my understanding is correct and offered the following simple rebuttal to the quoted extract from the Wings article;

"No alcohol duty is levied on Scotch Whisky exported from the UK to the EU or third countries, whether from Scottish ports or from ports elsewhere in the UK. UK alcohol duty (excise duty) is only levied on Scotch Whisky when released from bond for consumption in the UK. Under EU law, the rate of excise duty has to be consistent across the territory of a member state. If Scotland were an independent country, the rate of excise duty on Scotch Whisky would be set by a Scottish Government within the parameters for excise duty on alcoholic drinks set by the European Union.The excise duty revenue accruing to a Scottish exchequer would only be the amount raised on the release from bond of Scotch Whisky for consumption in Scotland."

It's definitely an example of "if you repeat a lie often enough, it becomes the truth."

ReplyDeleteOf course there are lots of other examples of this. Immigration being bad for the economy; the deficit pre-2008 contributing heavily to the recession.

The great advantage of the internet is that with an open mind and by seeking out a wide range of opinions and sources one can easily find out the truth behind the headlines and rhetoric.

The great shame of the internet is that too often we only read people we are likely to agree with and only consider facts that contribute to our own existing thinking.

It's definitely an example of "if you repeat a lie often enough, it becomes the truth."

ReplyDeleteOf course there are lots of other examples of this. Immigration being bad for the economy; the deficit pre-2008 contributing heavily to the recession.

The great advantage of the internet is that with an open mind and by seeking out a wide range of opinions and sources one can easily find out the truth behind the headlines and rhetoric.

The great shame of the internet is that too often we only read people we are likely to agree with and only consider facts that contribute to our own existing thinking.

Crown estates revenues, GERs conflicts!

ReplyDeleteAnswer to question in the Scottish parliament.

Crown estates revenue 2013-14

£11m

Answer from Scottish government to a FoI request

Crown estates revenue allocated to Scotland in GERs

£21m

Glad to help.

£11

http://www.scottish.parliament.uk/parliamentarybusiness/28877.aspx?SearchType=Advance&ReferenceNumbers=S4W-22104&ResultsPerPage=10

£21

https://www.whatdotheyknow.com/request/the_crown_estates_and_gers#incoming-642362

People believe what they want to believe and discard inconvenient truths as lies or propaganda.

ReplyDeleteIt was ever thus.

I came across someone arguing that the GERS figures were wrong a week or two ago, so I posted a link to your blog and said "There you go, point out where it all goes wrong." There was no reply. As you say, it's either a case of being incapable of understanding what the figures tell you or knowing and blatantly lying about it. Whichever it is, those in a position of influence should be aware they play a dangerous game if either is the case and they are asked to deliver on their promises.

ReplyDeleteI can only imagine the nature of the Twitter traffic you receive, but the "mute" option is a godsend in such circumstances.

Your use of the word "odious" reveals your approach, and your secret-love of Wings.

ReplyDeleteClack away. Word of advice; perhaps best not to use a Twitter handle that chimes with Average.

Excellent work. Please keep it up!

ReplyDeleteMark Davidson, nobody desputes that immigration contributes to the economy. It is a straw man. The argument is that mass immigration lowers wages, particularly of the lower skilled jobs. This is a fact. Agree with everything else, especially the deficit and the crash.

ReplyDeleteWonderful work.

ReplyDeleteIllustrates perfectly the Nat deception at work.

EXCELLENT WORK , keep it up you know you are hurting them when they bitch so much

ReplyDeleteOn the topic of the infamous "export duties", it's amazing that this has run for so long and really reveals both the dishonesty of those propagating it and the gullibility of those repeating it.

ReplyDeleteI guess people are thinking of import duties. (I'm using the verb "to think" in its broadest possible sense here.) As the name suggests, import duties are imposed and collected by the country of destination. Duties on the import of Scotch whisky to India, for example, go into Indian government coffers, so couldn't conceivably help to fund public spending in Scotland.

Playing devil's advocate here (though devil might be the wrong word, idiot seems more appropriate), I'm reading Mr. Campbell's latest argument is that if GERS figures for VAT/duty were derived from production rather than consumption, Scotland would get a magical extra 10 billion quid worth of revenue. GERS methodology mentions this as an alternative, but rejected, basis for computing VAT revenue.

ReplyDeleteUnsurprisingly, he has no working to show for the actual result of this - as the GERS methodology notes, this dumb idea would mean not including any tobacco revenue - but anyway, let's think through where the revenue goes for duty and VAT from production.

Assume you're a whiskey producer and you ship a container load of whiskey to Australia. No VAT or duty is payable in Scotland. Under Wings' methodology, you'd count the duty and VAT (actually GST) accrued as a result of this production as Scottish revenue. Only problem is, that duty and GST is collected and spent by the Australian government. Good luck asking for it back.

By the way, a comment on his blog back in November 2013 pointed out the error, and it was never corrected. Still, as long as the phrase 'export duty' never appears on his website, there's no error, right?

And he has the gall to now post on twitter that you're living in some kind of reality-denying bubble. Projecting much, Stuart?

Yup, whichever way you look at it, it's logical, demonstrable nonsense. Ask any accountant (and I am one), and they will quickly see the very obvious flaws and errors in Mr.Wangs/BfS "analysis"

ReplyDeleteAnd yet, and yet, and yet........countless, seemingly rational, intelligent people have fallen for this garbage. Call it what you will - confirmation bias, brainwashing, wilful ignorance. We can only hope (perhaps in vain) that we are still talking of only a small minority of Scots that have lost the ability to think critically and openly.

I've been following your weirdly scary ranting about this for a few days now, and I wonder if you could just clarify something I'm not understanding?

ReplyDelete1. The nats say GERS understates Scottish whisky revenue.

2. You've "disproved" this by linking to a page showing that while almost all whisky is produced in Scotland, only around 1/10th of the revenue from that production is attributed to the Scottish economy, partly because of the way the UK tax regime operates.

3. That seems to entirely prove the nats' point. Whisky is a product of Scotland, but GERS only gives Scotland 10% of it.

All the stuff about "export duty" is a red herring, and one which seems to have been entirely created by you. The basic fact is that 90% of the revenue accruing to the government from Scottish whisky production is credited to the rest of the UK.

An independent Scottish government would, unless it was very stupid, amend the taxation regime so that it got all the revenue. So what's your point?

The basic fact is that 90% of the revenue accruing to the government from Scottish whisky production is credited to the rest of the UK.

ReplyDeleteProduction is not taxed. End user sales are.

If someone buys a bottle of whisky in London the tax on that whisky is allocated to England. If they buy a bottle of Russian vodka the tax is allocated to England. If they buy a bottle of Belgian beer the tax is allocated to England. Scotland accounts for about 10% of the alcohol sales in the UK, so GERS attributes about 10% of alcohol tax receipts to Scotland.

When a bottle of whisky is sold in Scotland the tax on the sale is attributed to Scotland by GERS. However, a bottle of whisky sold in London or New York does not result in tax revenue being allocated to Scotland, but to England or the US.

An independent Scottish government would, unless it was very stupid, amend the taxation regime so that it got all the revenue.

How would Scotland control sales taxes in foreign countries? If you buy Russian vodka in the UK the UK government gets the sales taxes, not Russia. If you buy a BMW in France the French government gets the VAT, not Germany.

An independent Scotland could put production taxes on whisky, but they would be in addition to the sales taxes other countries collect. That would just make Scottish whisky more expensive than Irish, Japanese or US alternatives, and thus reduce sales.

Ken

ReplyDeleteI have to say I find it weirdly scary you can read all of this and still be so confused - it's my failing clearly, so let me try again.

The clearest "disproving" is the technical explanation I quote in full above taken directly from GERS - a document which the Scottish Government's Chief Statistician takes repsonsibility for. I've highlighted the important bits in yellow and everything.

If you're unable to follow that explanation then let me go through the logic for you on the "90% of the revenue accruing to the government from Scottish Whisky production is credited to the rest of the UK";

1. What you are doing is equivalent to arguing that duty charged in Japan or France on Sottish whisky sales should be attributed to the Scottish Government. This duty (like VAT or tobacco duty) is a charge to the consumer made by the government of the territory within which you buy the product. GERS hypothecates what Scotland would look like if independent from rUK; in that situation England would be like France or Japan - an export market which charges it's citizens alcohol duty none of which can be "attributed" to Scotland. We don't get that money.

2. If you prefer look at it the other way around. Scotland gets attributed tobacco duty on cigarettes manufactured outside Scotland - that duty shouldn't be "attributed" back to the manufacturing country. We get to keep duty we charge on sales within our borders. Biscuits made in Engalnd have VAT charged on them in Scotlannd; that VAT is rightly attributed to Scotland not back to England where those biscuits are made. We get to keep that money. Beer brewed in England sold in Scotland has duty paid on it by Scottish consumers; that duty is attributed to Scotland. We get to keep that money.

Duty is a sales tax that raises money for the territory within which those sales take place. We can no more lay claim to duty paid on whisky sales in England that Engalnd could claim duty paid on English brewed beer sold in Scotland.

You're right that export duty - or "alcohol duty at the point of export" to quote Wings verbatim - is a red herring. He introduced it to create confusion - can you see how succesfful he's been?

I really hope this is clearer now.

Thank you (geuninely) for taking the time to ask the question

Kevin

Yes, I understand how duty works, thanks. That's why I said an independent Scottish government would amend the taxation regime.

ReplyDeleteIf it taxed, say, at the wholesale level rather than the consumer one, then it's perfectly correct that foreign governments COULD continue to levy consumer duty at current levels. That would make whisky more expensive for the consumer in those nations.

But so what? The WORST-case scenario there is that the Scottish Exchequer would continue to get the same money as is attributed to it in GERS now, because in Scotland the price wouldn't have changed.

But what of the producers, you say? The reality is that unless the level of taxation was set wildly too high, whisky would still be in demand - it's already largely a premium product abroad and a modest increase in cost would likely have little effect on sales. So more money would accrue to the Scottish government, without damaging the industry.

I do understand your desperation to paint Scotland as a basket-case, but the fact is that the attribution of whisky revenue is a political choice by the UK government, not an economic imperative. Every penny delivered to the Treasury from the sale of Scotch whisky is a product of Scotland, yet only 10% of it is counted as such. That is fraudulent. Your attempts to portray it otherwise are crude sophistry aimed at dazzling the simple-minded.

Of course, according to Stu, "export duty" - which he defines as "a duty incurred by exporting" - is not what is meant by "UK alcohol duty [levied] at the point of export".

ReplyDeleteAnd even if that were the case, fine, whatever. The statement "alcohol produced in the UK which is exported abroad becomes subject to UK alcohol duty at the point of export" is simply incorrect. Stu is the one focussing on the term "export duty", because deflection and moving the goalposts is how he argues.

Out of interest, do you ever provide in-depth analysis regarding the UK's decade and a half long struggle to make a budget surplus (which at current projections aren't likely until closer to 2020)?

ReplyDeleteThe number of countries that regularly make budget surpluses in Europe are few and the UK definitely isn't one of them.

If you wished to see a financially secure and prosperous Scotland, why not enlighten people with your own plans for a healthier revenue/expenditure relationship.

Ken

ReplyDeleteYou're simply arguing for a new tax on whisky producers.

That has nothing to do with how existing taxes - you know, the ones that are actually paid now? - are included in GERS.

That has nothing to do with "revenues not being attributed to Scotland in GERS" as claimed by Wings

That has nothing to do with the "90%" of existing duty that he (and you) refer to as missing from GERS

I've tried really hard to be patient but life is too short to engage any further with you on this. Sorry.

We can discuss how taxes could be increased in an independent Scotland to fill the additional deficit gap. New taxes on whisky production (or caramel wafer production or shortbread production or tweed production ...) could be aprt of the solution. Let's just call it increaesed business taxation becasue that's what it is. Like the taxation that the SG blame for damaging the North Sea oil industry. The knloy problem is - of course - the SNP have at no point suggested raising taxes - in fact quite the reveres (APD, tourism VAT, taregtted SME tax relief) so you are rather off-script I'm afraid

Whisky sales are falling abroad. Possibly because it is seen as too expensive and substitutes are taking place.

ReplyDeleteAnd the 1/10th is correct if Scotland consumes 10% of sales within the UK. Otherwise to claim that Scotland is being didfles is brainless disingenuous nonsense.

To Ken Levant:

ReplyDeleteKevin took the words out of my mouth - you are simply arguing for a new production tax on whisky. This is completely different from what has been argued up to now.

The Nats would be screaming blue murder if this was implemented by a UK government - I can just hear the screams of "you're killing Scottish industry".

Honestly, if you still don't get this, if you still think we are being screwed, you have completely, utterly lost the plot. If this is what passes for informed opinion in Scotland now, we're all screwed.

I have a friend who has an accountancy degree and who runs a business with 12 employees. Despite this he firmly believes that Scotland would be much better off being independent. He has since recently qualified that by saying that it would tough for 5-10 years but we would be no worse off!

ReplyDeleteMy friends and I have repeatedly failed to get him to debate the financial implications for an independent Scotland. He simply believes it would work.

He also gleefully states that Britains debt is approaching £1.5 trillion. Telling him that every person in Britain, including Scotland, owes the same amount of debt per person solicites a blank stare.

He has now become a devoted cultee of Nicola Sturgeon and the SNP.

It's interesting how short-tempered you all become when politely challenged on your strident and abusive claims. There are two separate issues here:

ReplyDelete(1) That GERS - just as claimed by the nationalists - only credits 10% of the revenues generated by Scottish whisky sales in the UK to Scotland's economy. This is a fact, pure and simple, however much you try to disguise it and bluster your way around it.

(2) How an independent Scotland might in practice seek to maximise its revenues from that source. I've suggested AMENDING the taxation regime, not simply ADDING a new tax. It would be designed to be a cash-neutral move in terms of the domestic market and not impose any additional burden on producers.

However, as you're all now apparently too angry to discuss it, I'll bid you all good day and trouble you no further.

I look after an elderly parent with Dementia and I can have a more reasoned argument with her than is possible with a blinkered Nat.

ReplyDeleteKen, the tax revenue on a bottle of whisky is in two parts. The corporation tax on the pre-tax profits of the company producing the whisky and the consumption taxes (VAT/Sales Tax and Alcohol Duty).

ReplyDeleteGERS deals with these two sets of tax revenue in different ways.

In GERS the corporation tax is assigned based on where the economic activity occurs, NOT where the company HQ is located. Therefore ALL the corporation tax revenue resulting from sales (UK or Export) of Scotch whisky is assigned to Scotland (because you can’t make Scotch whisky anywhere else). But in addition GERS would also assign profits made on sales of Gordon’s London Dry Gin as it is made at Diageo’s Cameronbridge distillery. GERS Methodology 2013/2014 Pg. 13.

The consumption taxes are done differently. As the VAT/Sales Tax and Alcohol Duty are set by the country in which the whisky is consumed, and would also be collected in that country, GERS assigns the consumption taxes revenue to the country of consumption. Given that the population in the UK is split, roughly, 10% Scotland 90% rUK, GERS splits the consumption taxes revenue in the same ratio. GERS would also apply this approach for goods manufactured in the rUK but consumed in Scotland. For whisky exported outside of the UK no VAT or Alcohol Duty is levied or collected, that is done in the destination country. If the rUK was an independent country from Scotland, I am not sure we could justify taking a cut of consumption taxes in another sovereign state. The approach for consumption taxes is given in the GERS Methodology 2013/2014 Pg. 19 for VAT and Pg. 25 for Alcohol Duty.

In summary, GERS assigns 100% of the corporation tax revenue generated from UK scotch whisky sales to Scotland and the 10% of UK consumption tax revenue generated by sales in Scotland. No consumption tax revenue is generated in the UK by exports outside of the UK.

Your suggestion of levying a tax at wholesale point could have a number of effects. If it resulted in a sufficiently high end consumer price (wherever that consumer may be) it may suppress sales, which would reduce the company profits and hence the amount of corporation tax they would pay. Alternatively the company may reduce their profit margin to maintain the end consumer price and hence sales volume, but again this would ultimately reduce the corporation tax paid. Yet another would be for the company to reduce its costs to maintain their profit margin and end consumer price/sales volume, but this would normally mean an impact on employee salaries, and would hence reduce income tax revenue. Basically any additional tax revenue produced at the wholesale point would be offset by loses in either corporation tax or income tax, being overall effectively tax revenue neutral.

That is not to say you couldn’t try it, and premium/luxury products such as single malt scotch whisky can be price insensitive. However, blended scotch whisky is still far and away the major part of the scotch whisky industry and is quite price sensitive.

Ed

Ken

ReplyDeleteI'm not angry - I find your contribution highly entertaining.

1. To suggest the "10% of Scotch whisky duty allocated to Scotland" is some kind of injustice is ludicrous. 100% of duty on Scotch whisky sales in Scotland is allocated to Scotland. If you're outraged that those sales in England have the duty raised allocated to England you're presumably equally angered that the duty raised on sales in Japan is allocated to the Japanese government. Damn those cheating overseas markets eh? I imagine your anger is partly offset by the guilt you feel that duty raised on sales of English beer in Scotland is allocated to Scotland? Take a wee pause - think what is meant by the term "consumption tax" and it might all float into focus for you

2. This sounds great. "Cash neutral in terms of the domestic market and no financial burden on any of the producers"? Tell me more. Where will this money come from then? If you're creating new export duty (we're agreed no such thing exists today right?) then you are increasing the cost of our product to overseas markets. I have to tell you that that would place a "financial burden" on the producers (unless you think it makes no difference what a product costs in international markets in which case I have a business I'd like to sell you).

I know it's nice to think we can just create more tax revenue without it costing anybody but - come on Ken - you know life doesn't work like that.

I also wonder why you aren't applying the same logic to salmon or any other goods we export? Sounds like you've stumbled across a money tree here - we just AMEND tax structures to raise more money without affecting the domestic market or producers. You should have Swinney's job; if he'd known about your idea then Yes would have won by a landslide.

For those who may be interested.

ReplyDeletehttp://www.scotch-whisky.org.uk/media/62024/2012_statistical_report.pdf

Great blog Kevin. Always a good read!

ReplyDeleteIt depresses me reading some of the comments of the nats who simply don't have a clue whatsoever.

Its easy to pull the wool over someones eyes but far harder to convince them they've been taken up the garden path.

Ken - I think you need to look at the angle you want to debate and stick to it. You're moving goalposts to suit your argument.

ReplyDeleteIf you don't want to believe the figures stated in GERS, or indeed believe that GERS doesn't reflect Scotland's revenue correctly, do you NOT think that the SNP would have been all over this by now? They were happy to lie about Currency and EU membership but won't tell the "truth" on Scotland's missing Whisky revenue? You really think they'd miss a bombshell like that, given the lengths they are willing to go to for their sole aim of Indy?

Think about it. It would be the perfect reply to the ~£8bn FFA black hole we'd be facing.

Ignore duties and taxes right now and just let the above sink in. If you were sitting on a trump card which carried billions of pounds of missing revenue, would you not have played it during the referendum, given they were happy to lie (at tax-payer's expense) about so many other things?

If GERS is wrong, it's the SNP's fault as it's compiled by the SGs Chief Statistician.

If GERS is right, you have no basis to argue.

Kevin, commendations on an excellent blog providing rational analysis on the benefits if the union. A great antidote to the hate preaching 'wings over scotland'

ReplyDeleteI wonder whether you have read George Orwell's 'Notes on Nationalism' ? It is very insightful and of course highly applicable to the SNP, predicting their behaviour with surprising accuracy. It is available to read online here:

http://orwell.ru/library/essays/nationalism/english/e_nat

It's a very interesting post Ken. Keep Posting!!

ReplyDelete