I spent my high school years living on the Inner Hebridean island of Islay.

My school bus-route skirted the shores of Lochindaal - a magnificent sea loch which is home to thousands of barnacle geese in the winter. The journey would take about 45 minutes. Of course the nearer I got to home the emptier the bus would become and I'd gaze out of the window and let my mind wander.

Did she really smile at me today as she got off the bus? Of course not, she's just being polite. Way out of my league.

The last few miles of the journey were on single-track roads. That's when I'd transport myself through the window and travel along the wires strung between the telegraph poles. With enough mental effort I could keep up with the bus through a combination of running & speed-skating, jumping when the wires crossed the pylons, surfing when they sloped downwards. It passed the time.

Forgive the whimsy, but these memories have been roused by debates I've become embroiled in recently. Let me explain.

Think about the average transport cost of getting pupils to school when the communities served are remote and the travel distances long. Think what it costs to build and maintain miles of roads, some of which serve just a handful of people. Think about the telegraph line and power cable cost-per-person when delivering these vital services to remote areas.

With islands of course you have the added costs of sub-sea interconnects for power and telecoms, you have ferry subsidies. One of my summer jobs involved driving the hospital van to take laundry to the mainland, staying overnight and returning with clean laundry and fresh hospital supplies. Break a leg on Islay and the air-ambulance will fly you to Glasgow.

These are all illustrative examples of what we mean when we say that Scotland is a high "cost-to-serve" country. We have island communities and remote rural villages, our population density is only 20% as high as England's. It's inevitable that - if we are to come close to delivering equal service levels - our infrastructure and service costs will be higher on a per person basis than the rest of the UK.

As I've shown elsewhere on this blog (> Full Fiscal Autonomy For Dummies), this higher cost-to-serve is the main cause of the potential £7.6bn "black-hole" that Scotland would face if we were to be fiscally autonomous. Actually I don't like the tabloid friendly hyperbole of "black-hole" - let's just say "that would make us £7.6bn worse off".

Which is where we come to the dreaded "subsidy" word.

Nobody likes to think of themselves as subsidised and island folk are no exception - subsidy is a word laden with negative connotations. So in the context of the devolution debate and with my island upbringing you'll forgive me if I wearily suggest that I've kind of been here before.

Those of you who read my blog regularly will be aware that - when debating Scotland's national accounts (GERS) - I have been trenchant in my criticism of those exploiting confusion over how whisky duty revenue should be attributed.

Islay is home to 8 active distilleries and it used to be said you couldn't buy a blended whisky in Scotland that didn't contain at least one Islay malt. So it's perhaps not surprising that - normally when complaining about poor road surfaces or frequent power cuts - Ileachs are inclined to mention the amount of whisky duty the island generates on behalf of the Scottish government.

I have a confession to make here: as a teenager I never questioned that logic. So I really do understand how compelling that feels as an argument. I get why, in the context of the Scottish independence debate, some grievance seeking nationalists instinctively feel they should be able to claim any UK duty paid on whisky as "ours".

I won't waste time here explaining why whisky duty generated from sales of Bowmore whisky in Edinburgh is no more "attributable to Islay" than the duty charged on Scottish whisky sold in a London is "attributable to Scotland" (or indeed the duty on Russian vodka sold in Glasgow is "attributable to Russia"). Duty income is generated by the consumers buying the product (in whatever territory they may be). If you doubt this see the addenda to this post > Sowing The Seeds - it covers the logic and various arguments around attributing consumption taxes in soul-sapping detail.

Of course the whisky industry does create huge value, most obviously through direct employment, associated support industries and corporation tax. But if we're to draw the analogy of "Islay is to Scotland what Scotland is to the UK" then all of those sources of value are already correctly attributed in the GERS numbers. But let's not get lost in the technical detail again - this is all a side issue compared to the point I want to make.

If you ran the pro-forma national accounts for Islay I imagine they would show that Ileachs would be worse off independent than remaining in Scotland. Does that mean we should accuse Ileachs of being "subsidy junkies"? Is that a sad indictment of Scotland's treatment of the island over the last few hundred years? Of course not. In fact that observation should be a source of celebration, it's an illustration of how well our sharing society works.

It costs more to get kids on Islay to school than kids in Glasgow, it costs more to fly someone to hospital than to drive them. But I'm guessing that most Glaswegians don't give that a second thought. The principle that all citizens within our nation should be entitled to a good education and reasonable quality of healthcare is so engrained that it barely needs to be argued for.

Within a nation, we don't draw circles around groups of people and say "you're not paying your way". There will always be circles we could draw within a national map that will define net contributors and net beneficiaries. We don't do that because - I hope - it's instinctively the wrong thing to do.

But the devolution debate has been characterised by cries of "it's our oil" on one side (when the oil revenues are high) and "you're subsidy junkies" on the other (when the oil revenues are low).

It appears to me that the nationalists have been responsible for framing the debate in these blunt "economic value transfer" terms. So it's rather ironic that - having set out their grievance-stall based on the fact that Scotland contributes more than it get's back - the resultant focus on our finances has demonstrated that in fact the reverse is currently true.

Don't get me wrong: I think we should know what the simple financial implications of fiscal autonomy (or indeed independence) are, we should understand our pro-forma stand-alone national accounts. Indeed most of my blogging activity has been taken up by trying to ensure that we are honest with voters about what those numbers show us. But to allow the debate to be couched in these bean-counter's terms, to suggest that the right answer is simply a question of working out which solution makes us richer now (or might make us richer in 10 years' time) is surely wrong.

Once you pass a certain threshold of personal comfort and security it is - I hope - a natural and fundamentally decent human trait to want to look out for those who are less well off than you. That's why the welfare state exists, that's why we have the NHS. It's why we have Universal Service Obligations around essential utilities, so that those who live remotely aren't financially penalised.

Of course there are pros and cons of throwing your lot in with a wider group. If you don't have sufficient political influence or fiscal control, how exposed are you willing to be to the downsides of others' actions? We'll hear plenty more on this topic during the EU referendum I'm sure.

But putting the politics to one side, our willingness to throw our lot in with others - to "pool and share" - is, I suspect, largely dependent on our intuitive sense of likely reciprocation.

Which is where we come to the joyously positive example of the United Kingdom and how well it's worked for both Scotland and the rest of the UK.

When the windfall gain of North Sea oil appeared in the 1980's it meant that Scotland became a massive net contributor to the UK, we more than paid our way. We shouldn't feel aggrieved that that happened, we should celebrate it. We should no more resent the periods when we contribute than we should be embarrassed by the periods when (like now) we benefit.

Over time wherever you draw those circles on a map there's a chance that net beneficiaries may become net contributors and vice-versa.

For me that's why - whether we're discussing Scottish independence or EU membership - the objective should be to draw wider more inclusive circles, not smaller more insular ones.

Sunday, 31 May 2015

Sunday, 24 May 2015

Sowing the Seeds

Although its importance can easily be over-estimated, it's clear that social media plays an increasingly prominent role in political debate.

Twitter has been embraced by many of our leading politicians (in Scotland at least). The obvious advantage of Twitter is that it disintermediates; messages are not parsed by a sometimes unhelpful media but instead pass uneditted from the keypad of the politician to the screen of the reader.

For those who are smart enough not to outsource their account management to a press officer, Twitter offers a wonderful opportunity to project their true personalities. Women in Scottish politics seem to be particularly adept at this. During last year's Australian Open, our three most prominent female MSPs treated us to this rather marvellous exchange

Adding weight to the "female politicians are better at this than men" thesis is the recent arrival on Twitter of Johann Lamont (until recently leader of Scottish Labour's opposition). She has a fine line in self-deprecating wit, as she showed during last night's Eurovision

But of course it's not just about prominent figures taking the opportunity to demonstrate their character and humour. It's possible - in theory at least - to use social media as a way of engaging in substantive debate. It's true that Twitter's 140 character limit forces aphoristic brevity, but in the era of sound-bite politics and short attention spans that's arguably no bad thing. And of course for those keen to delve a little deeper both Twitter and Facebook can act as gateways through to more detailed expositions - the chances are you're reading this blog as the result of a Tweet or a Facebook posting.

The performance of politicians when it comes to using Twitter as a forum to engage (as opposed to project) is - in my experience - patchy at best. I've blogged before about the exchanges I've had with SNP MP's George Kerevan, Stewart Stevenson and Michelle Thomson. I'm maybe not best placed to judge, but I don't think any of their reputations were burnished by our interactions. The pattern is usually the same: they say something that's demonstrably untrue or at the very least misleading; I politely ask for clarification; they respond assuming they can bluff their way through; I demonstrate I know what I'm talking about; they go quiet. Of course Kerevan and Thomson were both elected to Westminster with landslide margins, so it's clear their interactions with me didn't cause them any lasting harm.

At least if politicans are on Twitter they can be swiftly and directly upbraided when they spout nonsense. In the past many of us have shouted at the television in frustration and achieved nothing more than startling our pets; now we can at least share our irritation with a wider audience.

Take this recent brief exchange with Angus MacNeil MP (after he attempted to misrepresent a piece of NIESR research).

He responded by blocking me immediately, which seemed a little harsh. But when I shared that fact it got widely retweeted. As of today my Twitter analytics tells me the Tweet below has been viewed by over 70,000 people.

Aa an aside: Angus Armstrong (a Director of NIESR) did respond to him pointing out that the NIESR hadn't implied what Mr MacNeil suggested. I don't know if Angus blocked him or not.

So far so good. These examples all show how social media generally and Twitter specifically can, in a small way, add to the quality of political debate.

There's a darker side to all of this of course. I have been asked few times by journalists about the abuse I receive online. My response is generally a shrug. What can sometimes seem like a lot of noise is usually no more than a handful of people. In the context of the volume of voices on Twitter it's frankly irrelevant and it's easy enough to block and move on.

But there is something about the burgeoning role of social media that bothers me far more than the trolls, cybernats and other online abusers: social media is an extremely powerful tool for spreading misinformation.

There has been plenty written about the role of social media in propogating conspiracy theories. Wikipedia suggests that between 6% and 20% of Americans and possibly 28% of russians believe the manned moon landings were fake.

The potential for ludicrous theories or beliefs to gain traction online has not gone unnoticed by the smarter political campaigners and, in my experience, the SNP have been particulary adept at exploiting this.

Let's take one simple example that my Twitter timeline is consistently plagued by: the suggestion that the official Governement Expenditure and Revenue Statistics (GERS) are totally flawed (and so can be safely ignored if they demonstrate what some of us would suggest are unfortunate truths).

The most common accusations are that they miss huge chunks of revenue because they fail to include export duty on whisky and VAT receipts that are recorded at company headquarters in London. There is no such thing as export Duty on Whisky and the VAT receipts in GERS are estimated, correctly, based on point of consumption. I've covered this in detail many times on this blog - the extract below is from my post on "How Scotland's Economy Contributes to the UK" if you need more convincing

The GERS figures are created by the Scottish Government and underpinned the economic case for Independence - so it is fair to assume that if there is any bias it would be to skew the picture in Scotland's favour.

HMRC produce their own figures (Table 4 in this HMRC Document shows methodological differences between HMRC and the Scottish Government) and pages 38 and 39 of GERS show that the differences between HMRC and GERS estimates are are in fact very small.

GERS estimate Scottish Tax revenues in 2013-14 to be 0.36%(£181m) higher than HMRC. The likes of Business for Scotland and Wings Over Scotland have made startlingly misinformed statements about VAT and Alcohol Duty that have led some people to doubt the validity of these figures.

If BfS and Wings were right it would be a terrifying indictment of the Scottish Government and the official Yes campaign's competence - but of course they are not right; the figures are sound.

References to VAT being "paid at companies' headquarters" and Scotland not getting attributed "Alcohol Duty at point of export" demonstrate a fundamental misunderstanding of how these taxes work and how they are attributed in GERS. These are consumption taxes and GERS estimates Scotland's share of these based on consumption data. There is no such thing as "Export Duty" on whisky (in fact you get Export Duty Relief); for the same reason we get to keep tobacco Duty despite not producing cigarettes. A 2 minute search of the official GERS Method Statement is enough to dispel these myths.

Twitter has been embraced by many of our leading politicians (in Scotland at least). The obvious advantage of Twitter is that it disintermediates; messages are not parsed by a sometimes unhelpful media but instead pass uneditted from the keypad of the politician to the screen of the reader.

For those who are smart enough not to outsource their account management to a press officer, Twitter offers a wonderful opportunity to project their true personalities. Women in Scottish politics seem to be particularly adept at this. During last year's Australian Open, our three most prominent female MSPs treated us to this rather marvellous exchange

@RuthDavidsonMSP I'm sure we could come to some arrangement - @kdugdalemsp?

— Nicola Sturgeon (@NicolaSturgeon) January 29, 2015

@RuthDavidsonMSP @NicolaSturgeon yes, there in a minute, looking for the Pimms

— Kezia Dugdale (@kdugdalemsp) January 29, 2015

Adding weight to the "female politicians are better at this than men" thesis is the recent arrival on Twitter of Johann Lamont (until recently leader of Scottish Labour's opposition). She has a fine line in self-deprecating wit, as she showed during last night's Eurovision

@NicolaSturgeon Oops. Don't tell me I am in the minority. Again.

— Johann Lamont (@JohannLamont) May 23, 2015

I don't know why this should be the case, but it's hard to imagine equivalent exchanges between prominent male politicians. More's the pity.But of course it's not just about prominent figures taking the opportunity to demonstrate their character and humour. It's possible - in theory at least - to use social media as a way of engaging in substantive debate. It's true that Twitter's 140 character limit forces aphoristic brevity, but in the era of sound-bite politics and short attention spans that's arguably no bad thing. And of course for those keen to delve a little deeper both Twitter and Facebook can act as gateways through to more detailed expositions - the chances are you're reading this blog as the result of a Tweet or a Facebook posting.

The performance of politicians when it comes to using Twitter as a forum to engage (as opposed to project) is - in my experience - patchy at best. I've blogged before about the exchanges I've had with SNP MP's George Kerevan, Stewart Stevenson and Michelle Thomson. I'm maybe not best placed to judge, but I don't think any of their reputations were burnished by our interactions. The pattern is usually the same: they say something that's demonstrably untrue or at the very least misleading; I politely ask for clarification; they respond assuming they can bluff their way through; I demonstrate I know what I'm talking about; they go quiet. Of course Kerevan and Thomson were both elected to Westminster with landslide margins, so it's clear their interactions with me didn't cause them any lasting harm.

At least if politicans are on Twitter they can be swiftly and directly upbraided when they spout nonsense. In the past many of us have shouted at the television in frustration and achieved nothing more than startling our pets; now we can at least share our irritation with a wider audience.

Take this recent brief exchange with Angus MacNeil MP (after he attempted to misrepresent a piece of NIESR research).

@AngusMacNeilSNP

Do you have a link for that - would be interesting to unpick those numbers.

Thanks

— Kevin Hague (@kevverage) May 20, 2015

He responded by blocking me immediately, which seemed a little harsh. But when I shared that fact it got widely retweeted. As of today my Twitter analytics tells me the Tweet below has been viewed by over 70,000 people.

Democracy, Scotland 2015 pic.twitter.com/wNnvuUdfaX

— Kevin Hague (@kevverage) May 20, 2015

I'm sure Angus won't be losing any sleep over this, but it is at least more satisfying for me than an impotent rant at the TV. And my dog's slumber was undisturbed; this has to be seen as progress.Aa an aside: Angus Armstrong (a Director of NIESR) did respond to him pointing out that the NIESR hadn't implied what Mr MacNeil suggested. I don't know if Angus blocked him or not.

@AngusMacNeilSNP No-one @NIESRorg has made this claim. Austerity may have led to loss of UK output but this implies nothing about FFA #bbcsp

— Angus Armstrong (@angusarmstrong8) May 20, 2015

So far so good. These examples all show how social media generally and Twitter specifically can, in a small way, add to the quality of political debate.

There's a darker side to all of this of course. I have been asked few times by journalists about the abuse I receive online. My response is generally a shrug. What can sometimes seem like a lot of noise is usually no more than a handful of people. In the context of the volume of voices on Twitter it's frankly irrelevant and it's easy enough to block and move on.

But there is something about the burgeoning role of social media that bothers me far more than the trolls, cybernats and other online abusers: social media is an extremely powerful tool for spreading misinformation.

There has been plenty written about the role of social media in propogating conspiracy theories. Wikipedia suggests that between 6% and 20% of Americans and possibly 28% of russians believe the manned moon landings were fake.

The potential for ludicrous theories or beliefs to gain traction online has not gone unnoticed by the smarter political campaigners and, in my experience, the SNP have been particulary adept at exploiting this.

Let's take one simple example that my Twitter timeline is consistently plagued by: the suggestion that the official Governement Expenditure and Revenue Statistics (GERS) are totally flawed (and so can be safely ignored if they demonstrate what some of us would suggest are unfortunate truths).

The most common accusations are that they miss huge chunks of revenue because they fail to include export duty on whisky and VAT receipts that are recorded at company headquarters in London. There is no such thing as export Duty on Whisky and the VAT receipts in GERS are estimated, correctly, based on point of consumption. I've covered this in detail many times on this blog - the extract below is from my post on "How Scotland's Economy Contributes to the UK" if you need more convincing

The GERS figures are created by the Scottish Government and underpinned the economic case for Independence - so it is fair to assume that if there is any bias it would be to skew the picture in Scotland's favour.

HMRC produce their own figures (Table 4 in this HMRC Document shows methodological differences between HMRC and the Scottish Government) and pages 38 and 39 of GERS show that the differences between HMRC and GERS estimates are are in fact very small.

GERS estimate Scottish Tax revenues in 2013-14 to be 0.36%(£181m) higher than HMRC. The likes of Business for Scotland and Wings Over Scotland have made startlingly misinformed statements about VAT and Alcohol Duty that have led some people to doubt the validity of these figures.

If BfS and Wings were right it would be a terrifying indictment of the Scottish Government and the official Yes campaign's competence - but of course they are not right; the figures are sound.

References to VAT being "paid at companies' headquarters" and Scotland not getting attributed "Alcohol Duty at point of export" demonstrate a fundamental misunderstanding of how these taxes work and how they are attributed in GERS. These are consumption taxes and GERS estimates Scotland's share of these based on consumption data. There is no such thing as "Export Duty" on whisky (in fact you get Export Duty Relief); for the same reason we get to keep tobacco Duty despite not producing cigarettes. A 2 minute search of the official GERS Method Statement is enough to dispel these myths.

But browse the comments section of my blog or engage in any GERS numbers based debate on Twitter and you'll see that these untruths are well established in the minds of many voters. How do they become so firmly rooted?

You won't (as far as I'm aware) hear any elected MSP suggesting the GERS figures are fundamentally flawed - they would look ridiculous if they did. But you don't have to look too far to see how this misinformation has been seeded online by the SNP's cheerleaders.

This post from the awful "Wings Over Scotland" is still available for all to see - amongst a lot of nonsense it includes the following paragraph

So we can see how these falsehoods (and many others) are shamelessly seeded by the SNP's influential social media taskforce. Of course our social media savvy SNP MPs and MSPs do nothing to disabuse their followers of the resulting false perceptions.

This stuff takes root. That Wings Over Scotland post was made in November 2013 and is still consistently cited as "proof" that the GERS figures are wrong. Of course the beauty of a blog, of online materials generally, is that if errors are pointed out it's the work of moments to correct them. So either the blog's author (the odious* "Reverend" Stuart Campbell) doesn't realise his mistake or he's happy to perpetuate what he knows to be an untruth. There are plenty more examples I could cite; I'm pretty sure he knows precisely what he's doing.

This to me is far more concerning than people like me receiving a few snide, snarky and occasionally downright nasty tweets.

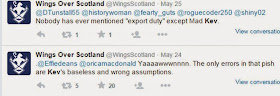

Incredibly there has been a storm of people on Twitter (including the Rev himself) defending these ludicrous claims that he's published.

Firstly let's be absolutely clear: GERS does not miss out Scottish Revenues - the whole point of GERS is to hypothecate a stand-alone Scotland's finances and it's created by the Scottish Government and was the foundation of the White Paper.

On the specific excise duty point - the 2008 GERS incudes this helpful summary which I quote in its entirety here (highlighting mine obviously):

If in doubt, here's the Scotch Whisky Association on the topic

You might think the Reverend would have the sense to back down gracefully - lol.

This is how he's responded (do read through to the denouement)

The abuse aside*, it's frankly hilarious that he finishes by attempting to reinforce the belief he's actively propagated - namely that GERS misses a load of revenue that should rightfully be attributed to Scotland.

He plays semantics around "export duty" not being mentioned - I quoted him verbatim in my original post and my timeline is littered with people using the phrase "export duty" and linking back to his article as "proof".

In case anybody is won over by his "export duty wasn't mentioned point", this is the end of the Wings article that I was quoting from (if you can stomach reading the whole article it makes the same erroneous point about VAT reporting);

So Wings tells his followers that GERS is missing a figure that "would likely" be £10bn+.

He really should be on the phone to the person who takes responsibility for the GERS figures - the Scottish Government's Chief Statistician.

* for those who question my use of the term "odious" I refer you to the above and his timeline in general

While writing the above Addendum I emailed a highly respected industry expert who - given the abuse I've been receiving - understandably wishes to remain anonymous. On this one I'm afraid you'll have to take my word for ot that this chap knows his stuff. He confirms that my understanding is correct and offered the following simple rebuttal to the quoted extract from the Wings article;

You won't (as far as I'm aware) hear any elected MSP suggesting the GERS figures are fundamentally flawed - they would look ridiculous if they did. But you don't have to look too far to see how this misinformation has been seeded online by the SNP's cheerleaders.

This post from the awful "Wings Over Scotland" is still available for all to see - amongst a lot of nonsense it includes the following paragraph

There are other ways in which Scottish revenues are invisible in the official statistics. Much of the alcohol duty paid by our whisky industry is not counted as revenue from Scotland. Alcohol produced in the UK which is exported abroad becomes subject to UK alcohol duty at the point of export, and a large proportion of Scotland’s multibillion whisky exports gets shipped out from ports in England. The UK Treasury counts the duty levied on this whisky as income from the tax region in which the port is situatedThis is of course simply, demonstrably and unequivocally complete rubbish. Funnily enough the same paragraph appears in a paper from the similarly ludicrous Business for Scotland. They didn't even bother rewording it - it's a direct cut & paste job. That seems to be how the SNP mouthpieces work.

So we can see how these falsehoods (and many others) are shamelessly seeded by the SNP's influential social media taskforce. Of course our social media savvy SNP MPs and MSPs do nothing to disabuse their followers of the resulting false perceptions.

This stuff takes root. That Wings Over Scotland post was made in November 2013 and is still consistently cited as "proof" that the GERS figures are wrong. Of course the beauty of a blog, of online materials generally, is that if errors are pointed out it's the work of moments to correct them. So either the blog's author (the odious* "Reverend" Stuart Campbell) doesn't realise his mistake or he's happy to perpetuate what he knows to be an untruth. There are plenty more examples I could cite; I'm pretty sure he knows precisely what he's doing.

This to me is far more concerning than people like me receiving a few snide, snarky and occasionally downright nasty tweets.

ADDENDUM

Incredibly there has been a storm of people on Twitter (including the Rev himself) defending these ludicrous claims that he's published.

Firstly let's be absolutely clear: GERS does not miss out Scottish Revenues - the whole point of GERS is to hypothecate a stand-alone Scotland's finances and it's created by the Scottish Government and was the foundation of the White Paper.

On the specific excise duty point - the 2008 GERS incudes this helpful summary which I quote in its entirety here (highlighting mine obviously):

Value Added Tax ( VAT) and excise duties are the principal elements of indirect taxation ( i.e. taxes on products) in the UK.

VAT is charged on the final consumption of certain goods and services and is levied at 17.5% of the purchase price, though a reduced rate of 5% is levied on some items.

Alcohol excise duty is a flat-rate duty on alcoholic beverages while tobacco duty is a combination of flat rate duty and an ad valorem tax charged on cigarettes, cigars and loose tobacco. Any revisions to VAT and excise duties are announced during UK Budget and Pre-Budget ( PBR) reports.

Two alternative apportionment methodologies can be applied to VAT and excise duties.

In GERS, VAT and excise duty estimates for Scotland are based on the consumption approach.

- Consumption based approach - apportioning VAT and excise duty to the region in which the good was consumed.

- Production based approach - apportioning VAT and excise duty to the region in which the good was produced.

This is appropriate as the burden of the duty is borne by the final consumer rather than the producer. This is considered best practice as within a system of regional fiscal accounts, the VAT liability 'sticks' when the item is purchased by the final consumer. The location of production is of no relevance.

Tobacco and alcohol duties are only collected if the product is consumed in the UK. If the product is exported, the producer receives export relief. For example, while duty is levied on Scotch Whisky when it leaves a bonded warehouse, in reality it is only collected if the whisky is consumed in the UK. Consequently, the ultimate payer of the duty is the UK consumer of the product.

Therefore, GERS estimates duty collected from Scotch Whisky based upon the level of whisky consumption in Scotland, even though Scotch Whisky is only produced in Scotland. Similarly, the estimate of tobacco duty collected in Scotland is based upon the level of consumption of tobacco products in Scotland, even though most tobacco goods are produced outside Scotland.So his article that talks about missing Scottish revenues because of excise duties levied at English ports is just wrong.

If in doubt, here's the Scotch Whisky Association on the topic

@scotspoond We have no reason to query the HMRC figures.

— Scotch Whisky Assoc. (@ScotchWhiskySWA) April 15, 2015

This is how he's responded (do read through to the denouement)

The abuse aside*, it's frankly hilarious that he finishes by attempting to reinforce the belief he's actively propagated - namely that GERS misses a load of revenue that should rightfully be attributed to Scotland.

He plays semantics around "export duty" not being mentioned - I quoted him verbatim in my original post and my timeline is littered with people using the phrase "export duty" and linking back to his article as "proof".

In case anybody is won over by his "export duty wasn't mentioned point", this is the end of the Wings article that I was quoting from (if you can stomach reading the whole article it makes the same erroneous point about VAT reporting);

Billions of pounds of Scottish revenue is magicked away in the official statistics, and doesn’t count as Scottish revenue. It masquerades as revenue from other parts of the UK, most commonly as revenue from London. In total, the extra revenues which don’t currently figure in the GERS stats, but would accrue to an independent Scottish Treasury, would likely be larger than the entire annual income from the North Sea.This article was published in November 2013 - at that time the most recent annual income from the North Sea was £9.7bn.

So Wings tells his followers that GERS is missing a figure that "would likely" be £10bn+.

He really should be on the phone to the person who takes responsibility for the GERS figures - the Scottish Government's Chief Statistician.

* for those who question my use of the term "odious" I refer you to the above and his timeline in general

ADDENDUM 2

While writing the above Addendum I emailed a highly respected industry expert who - given the abuse I've been receiving - understandably wishes to remain anonymous. On this one I'm afraid you'll have to take my word for ot that this chap knows his stuff. He confirms that my understanding is correct and offered the following simple rebuttal to the quoted extract from the Wings article;

"No alcohol duty is levied on Scotch Whisky exported from the UK to the EU or third countries, whether from Scottish ports or from ports elsewhere in the UK. UK alcohol duty (excise duty) is only levied on Scotch Whisky when released from bond for consumption in the UK. Under EU law, the rate of excise duty has to be consistent across the territory of a member state. If Scotland were an independent country, the rate of excise duty on Scotch Whisky would be set by a Scottish Government within the parameters for excise duty on alcoholic drinks set by the European Union.The excise duty revenue accruing to a Scottish exchequer would only be the amount raised on the release from bond of Scotch Whisky for consumption in Scotland."

Saturday, 16 May 2015

With Great Fiscal Power Comes Great Fiscal Responsibility

The issue of "further powers" for Holyrood was discussed at Bute House on Friday when our Conservative Prime Minister met with our SNP First Minister.

This picture is a stark illustration that those who argued "vote SNP and get a Tory government" might just have had a point. Certainly if you buy the argument that Labour's woes in England were exacerbated by Tory warnings about the risks of an SNP influenced Labour government, it's hard not to conclude that the SNP have contributed to the Conservatives' success.

No matter; we are where we are.

Sturgeon is now able to negotiate on behalf of Scotland with the extraordinary mandate that the Scottish people have given her party. They have 56 of Scotland's 59 MP's at Westminster (in case you hadn't heard).

The very fact that the meeting took place in Scotland may have been relevant; was this a conciliatory decision on Cameron's part? Of course he may just have been wary of holding the meeting at Number 10 in case Sturgeon attempted to deliver on her promise to lock him out.

What is clear is that the debate about more powers is going to dominate our political discourse for some time to come.

I confess to a certain weariness with all of this. We had the referendum, we had the Smith Commission, we've had the general election, we are less than a year away from the next Holyrood election and of course we now have an EU referendum to look forward to. It would be nice to think that somewhere in amongst all of this electioneering, referendum campaigning and constitutional negotiation our politicians would be able to pay some attention to the small matter of running the country.

But the drip-drip water-torture of the Nationalists' demands for more powers isn't going to stop anytime soon. They've been at this for a while. I was perusing a rather well-stocked bookshelf the other day and was amused to stumble across this book published by "London Scots Self-Government Committee" nearly 75 years ago.

I confess it requires more stamina and patience than I possess not to be at least tempted to consider simply ceding to the SNP's demands for Full Fiscal Autonomy (FFA) - as long as it really is full autonomy, including the removal of any Barnett-style subsidy.

The SNP have back-tracked spectacularly on this demand of course. In a move that must surely have had many of the less well-informed Yes voters scratching their heads, SNP MP & economist George Kerevan went on record last week to say

So it is to Cameron's immense credit that his statement after the Bute House meeting was so unequivocal;

Whether you think that quote is attributable to Voltaire or Spider-Man's uncle Ben, it has resonance in this debate.

The reason why the FFA debate has become so confused is that when the SNP now argue for Full Fiscal Responsibility with "UK-wide fiscal balancing" they are in fact arguing for fiscal power without the associated fiscal responsibility.

As long as we continue to share a currency, a central bank and responsibility for our share of the national debt then our economic fates remain interconnected.

Given that reality it would clearly be unacceptable for a Fiscally Autonomous Scotland to continually run a higher deficit and to be contributing disproportionately to our national debt. Whether some of that debt is ring-fenced to Scotland is beside the point - if the ability of Scotland to bear its share of the national debt becomes compromised, the cost of that would fall back on the rest of the UK. If Scotland is unable (or unwilling) to control its own affairs such that its deficit is in-line with the rest of the UK (i.e. without the need for balancing fiscal transfers like those Barnett delivers), it is only reasonable that the rest of the UK retains control over the fiscal levers. You can't have the economic power if you don't take the economic responsibility.

This is of course why the Yes campaign floundered so badly on the issue of currency; you can't be truly independent and share a currency, you have to adhere to fair fiscal constraints. Ask Greece.

So let's move on assuming that FFA is off the table. This means we need to focus our attention on the debate that was reignited by the referendum and progressed through the Smith Commission: what further powers (in addition to Smith) should be devolved to Scotland?

To sensibly progress this debate I'd suggest we have to ask not just how any further devolved powers could be used but also how they could be abused. Is there a risk that these powers could be used in a way that might damage the UK as a whole? We have to ask who will be wielding these powers and to what end.

Fortunately the SNP's written constitution is very clear on this matter

A simpler illustration of this point is a quote that I have heard attributed to a civil servant describing John Swinney's motivation: "You have to remember, John would live in a cave to be free".

If we're devolving power into the hands of Nationalists motivated by the destruction of the UK then some of us might conclude that devolving more power is not necessarily a good thing. If you think I'm over-stating this case, let me remind you of the written SNP candidate statement made by George Kerevan

But it's not just about the potential for what some of us would see as malicious misuse of these devolved powers. After all, if you're one of those who believe the paranoid conspiracy theories about Westminster's vendetta against the Scots, you are just as likely to distrust how those powers are used now.

The more subtle point here is that devolved powers may create a situation where rationally self -interested behaviour could still be value destructive for the UK as a whole.

Take two of the issues that appear high on the SNP's agenda when they argue that the Smith Commission proposals do not go far enough; the Minimum Wage and Corporation tax.

I'm intuitively in favour of raising the minimum wage. We have a problem with in-work-poverty and shifting some of the burden away from the state and on to business doesn't seem unreasonable to me. But as I argued in the Smith Commission submission I contributed to: allowing differential minimum wage levels within the UK would be value destructive. A higher minimum wage in Scotland would damage competitiveness of Scottish businesses and cause some businesses (or entrepreneurs) to move South at the expense of Scottish jobs; a lower minimum wage would be be potentially damaging to social welfare by encouraging a regional low-wage economy.

I've also covered the corporation tax argument elsewhere on this blog. I'm a businessman who would benefit from lower corporation tax in Scotland but I think it's a bad idea for three reasons

There are strong, rational, UK-wide arguments against devolving the ability to set the minimum wage or corporation tax rates.

The Smith Commission may have been necessarily rushed but it seems to me they did a pretty good job. They defined a series of further powers and a set of principles that delivered against "The Vow" whilst limiting the risks of these powers causing UK-wide value destruction. Of course they didn't go far enough for the SNP; nothing short of full independence will ever be enough for the SNP.

So surely it would be appropriate at this stage to focus on delivering the powers already proposed and seeing how these are actually used before pushing for yet more devolution?

Without FFA the SNP may be spared from showing how their "anti-austerity" rhetoric would translate into action if they were actually accountable for the resultant debt ... but with Smith powers they should be able to demonstrate their progressive credentials by redistributing the tax burden.

It will be interesting to see how the SNP's popularity survives when they start demanding a little less and are forced to start delivering a little more.

This picture is a stark illustration that those who argued "vote SNP and get a Tory government" might just have had a point. Certainly if you buy the argument that Labour's woes in England were exacerbated by Tory warnings about the risks of an SNP influenced Labour government, it's hard not to conclude that the SNP have contributed to the Conservatives' success.

No matter; we are where we are.

Sturgeon is now able to negotiate on behalf of Scotland with the extraordinary mandate that the Scottish people have given her party. They have 56 of Scotland's 59 MP's at Westminster (in case you hadn't heard).

The very fact that the meeting took place in Scotland may have been relevant; was this a conciliatory decision on Cameron's part? Of course he may just have been wary of holding the meeting at Number 10 in case Sturgeon attempted to deliver on her promise to lock him out.

What is clear is that the debate about more powers is going to dominate our political discourse for some time to come.

I confess to a certain weariness with all of this. We had the referendum, we had the Smith Commission, we've had the general election, we are less than a year away from the next Holyrood election and of course we now have an EU referendum to look forward to. It would be nice to think that somewhere in amongst all of this electioneering, referendum campaigning and constitutional negotiation our politicians would be able to pay some attention to the small matter of running the country.

But the drip-drip water-torture of the Nationalists' demands for more powers isn't going to stop anytime soon. They've been at this for a while. I was perusing a rather well-stocked bookshelf the other day and was amused to stumble across this book published by "London Scots Self-Government Committee" nearly 75 years ago.

I confess it requires more stamina and patience than I possess not to be at least tempted to consider simply ceding to the SNP's demands for Full Fiscal Autonomy (FFA) - as long as it really is full autonomy, including the removal of any Barnett-style subsidy.

The SNP have back-tracked spectacularly on this demand of course. In a move that must surely have had many of the less well-informed Yes voters scratching their heads, SNP MP & economist George Kerevan went on record last week to say

"For Scotland to accept fiscal autonomy without inbuilt UK-wide fiscal balancing would be tantamount to economic suicide"Remember the transparently misleading economic claims made by the SNP during the Independence Referendum? Their declared determination to "kick the last Tory out of Scotland"? In that context it would be understandable if David Cameron adopted the position - voiced by many senior figures in his party - that he should give the Scots the Fiscal Autonomy they appear to have asked for and see how they like it. After all, it would help his desire to implement English Votes for English Laws and be economically beneficial to the rest of the UK.

So it is to Cameron's immense credit that his statement after the Bute House meeting was so unequivocal;

“I think the option of full fiscal autonomy is not a good option for Scotland inside the United Kingdom. I think it would land Scottish taxpayers with £7 billion of extra taxes or the Scottish people with £7bn of extra cuts. I believe in the solidarity at the heart of the United Kingdom, so it is an honest disagreement between the First Minister and me about this. But we will deliver a stronger Scottish Parliament. Be in no doubt.”As an aside: the "honest disagreement" wording implies that Sturgeon was in fact arguing for Full Fiscal Autonomy without "fiscal balancing" (because that's where the £7bn comes from). The implication is that she was arguing for what her own economist MP describes as "economic suicide". Either we have a kamikaze pilot in control of Scotland's economic destiny or Cameron is playing word-games. What's scary is I find either option equally credible.

"With great power comes great responsibility"

Whether you think that quote is attributable to Voltaire or Spider-Man's uncle Ben, it has resonance in this debate.

The reason why the FFA debate has become so confused is that when the SNP now argue for Full Fiscal Responsibility with "UK-wide fiscal balancing" they are in fact arguing for fiscal power without the associated fiscal responsibility.

As long as we continue to share a currency, a central bank and responsibility for our share of the national debt then our economic fates remain interconnected.

Given that reality it would clearly be unacceptable for a Fiscally Autonomous Scotland to continually run a higher deficit and to be contributing disproportionately to our national debt. Whether some of that debt is ring-fenced to Scotland is beside the point - if the ability of Scotland to bear its share of the national debt becomes compromised, the cost of that would fall back on the rest of the UK. If Scotland is unable (or unwilling) to control its own affairs such that its deficit is in-line with the rest of the UK (i.e. without the need for balancing fiscal transfers like those Barnett delivers), it is only reasonable that the rest of the UK retains control over the fiscal levers. You can't have the economic power if you don't take the economic responsibility.

This is of course why the Yes campaign floundered so badly on the issue of currency; you can't be truly independent and share a currency, you have to adhere to fair fiscal constraints. Ask Greece.

So let's move on assuming that FFA is off the table. This means we need to focus our attention on the debate that was reignited by the referendum and progressed through the Smith Commission: what further powers (in addition to Smith) should be devolved to Scotland?

Fortunately the SNP's written constitution is very clear on this matter

"The aims of the party shall be (a) Independence for Scotland [..] (b) the furtherance of all Scottish interests'"If the Independence Referendum taught us anything it is surely that for the SNP clause (a) trumps clause (b) every time. Nobody can now seriously believe that the SNP were not aware Independence would have made us poorer. Remember that FFA is effectively Independence without the associated independence downsides (most notably currency and potential job losses as businesses who serve the UK from Scotland relocate to avoid exposure to export risk). Even the SNP themselves now tacitly accept - or in Mr Kerevan's case explicitly state - that Scotland's economy is in far worse shape than that we share by being an integral part of the UK.

A simpler illustration of this point is a quote that I have heard attributed to a civil servant describing John Swinney's motivation: "You have to remember, John would live in a cave to be free".

If we're devolving power into the hands of Nationalists motivated by the destruction of the UK then some of us might conclude that devolving more power is not necessarily a good thing. If you think I'm over-stating this case, let me remind you of the written SNP candidate statement made by George Kerevan

".. After Home Rule, independence will follow as the UK economy implodes .."This is the same Mr Kerevan who the Scotsman recently revealed is the SNP member invited to help "draw up plans for a federal UK". Just think about that for a moment.

But it's not just about the potential for what some of us would see as malicious misuse of these devolved powers. After all, if you're one of those who believe the paranoid conspiracy theories about Westminster's vendetta against the Scots, you are just as likely to distrust how those powers are used now.

The more subtle point here is that devolved powers may create a situation where rationally self -interested behaviour could still be value destructive for the UK as a whole.

Take two of the issues that appear high on the SNP's agenda when they argue that the Smith Commission proposals do not go far enough; the Minimum Wage and Corporation tax.

I'm intuitively in favour of raising the minimum wage. We have a problem with in-work-poverty and shifting some of the burden away from the state and on to business doesn't seem unreasonable to me. But as I argued in the Smith Commission submission I contributed to: allowing differential minimum wage levels within the UK would be value destructive. A higher minimum wage in Scotland would damage competitiveness of Scottish businesses and cause some businesses (or entrepreneurs) to move South at the expense of Scottish jobs; a lower minimum wage would be be potentially damaging to social welfare by encouraging a regional low-wage economy.

I've also covered the corporation tax argument elsewhere on this blog. I'm a businessman who would benefit from lower corporation tax in Scotland but I think it's a bad idea for three reasons

- Using differential corporation tax rates to shift business activity around the country is value destructive to the UK as a whole - it simply reduces the UK's overall corporation tax take and hands money back to profitable businesses instead of targeting the less well-off in society

- It creates incentives for creative accounting within businesses to ensure profits are reported in low tax areas of the UK without necessarily needing to change any real economic activity. Just look at the tax avoidance strategies of Google, Amazon, Starbucks etc. - if they'll do that across international tax borders we can safely assume they would apply similar accounting strategies within the UK

- It places an additional reporting burden on UK businesses who would have to report (and audit) Scottish profit separately from rUK profit. Trust me that for many businesses this would be a non-trivial exercise.

There are strong, rational, UK-wide arguments against devolving the ability to set the minimum wage or corporation tax rates.

The Smith Commission may have been necessarily rushed but it seems to me they did a pretty good job. They defined a series of further powers and a set of principles that delivered against "The Vow" whilst limiting the risks of these powers causing UK-wide value destruction. Of course they didn't go far enough for the SNP; nothing short of full independence will ever be enough for the SNP.

So surely it would be appropriate at this stage to focus on delivering the powers already proposed and seeing how these are actually used before pushing for yet more devolution?

Without FFA the SNP may be spared from showing how their "anti-austerity" rhetoric would translate into action if they were actually accountable for the resultant debt ... but with Smith powers they should be able to demonstrate their progressive credentials by redistributing the tax burden.

It will be interesting to see how the SNP's popularity survives when they start demanding a little less and are forced to start delivering a little more.

Sunday, 10 May 2015

George Kerevan, my new SNP MP

Back in February I was trying to work out who in the SNP actually understood economics; I was directed towards George Kerevan

@kevverage George Kerevan, lecturer in economics for over 25 years, Salmond, chief economist at RBS (when it behaved like a bank)

— 2tall2BaHobbit (@namechange64) February 16, 2015

Well Salmond's tenuous grasp on economic reality is comprehensively covered in this blog but I hadn't heard much about Mr Kerevan.

I've just googled around a bit and he was (perhaps unsurprisingly) rather quiet during the independence referendum. I did find a Scotsman article (from March 8th 2013) which contains this peach;

"Far from being worse off, Scotland would be getting richer at around £500 per person per year on these figures. (By the way, the OBR only gets Scotland’s 2016-17 deficit lower than for the rest of UK by predicating unrealistically low oil prices.)"OK so he was spectacularly wrong about that but he's hardly alone there.

About a month ago I read his Buzzfeed piece responding to IFS highlighting the black-hole that would be revealed by Full Fiscal Autonomy. He's an economist so he doesn't attempt to deny the existence of the deficit gap. Instead he argues

"However, IFS is making the political assumption that any Scottish Government spending per capita – above and beyond the UK average – will have to be fully funded from Scottish resources"Now hold on a minute.

The whole independence campaign was run on a "we'd be better off" (and "we'd be getting richer") message from the Yes camp. Anybody who questioned our ability to fund our higher public spending from our own tax revenues was accused of thinking Scotland was "too wee, too poor, too stupid". But now we're told it's ridiculous to assume our spending should be funded purely from our own resources.

It's hard to know whether to laugh, cry or turn to drink.

Of course this spectacular inconsistency - this tacit admittance that the economic claims made during the indyref were nonsense - mattered not a jot. Nothing could stop the SNP juggernaut as they swept all before them at last week's general election.

In a further cruel twist it transpired that George was campaigning to be my MP. I live in what is now "his"constituency of East Lothian. This meant my interest was particularly piqued when I saw his "candidate statement" (intended for SNP eyes only, leaked originally in the Scotsman);

I apologise that the image is a little blurry - these are the words that caught my eye;

"After Home Rule, independence will follow as the UK economy implodes [..] I would relish the chance to take Scotland's fight to the enemy camp"I thought I'd seek clarification from Mr Kerevan directly;

/@GeorgeKerevan

Also can you please explain the causal link between home rule and UK economic implosion

Thanks pic.twitter.com/fylMLte6nw

— Kevin Hague (@kevverage) April 27, 2015

It seems the enemy is "undemocratic Westminster". Right.

@GeorgeKerevan @Susan_Paterson @holland_tom

So undemocratic that George has to resort to trying to get elected to reform it

— Kevin Hague (@kevverage) April 27, 2015

@holland_tom @GeorgeKerevan

Also George: you say you're taking the fight to the "enemy camp"

Systems don't live in camps, people do.

— Kevin Hague (@kevverage) April 28, 2015

But fair enough. He's been decent enough to respond and the "enemy" rhetoric is hardly surprising in an internal SNP document.But given he's an economist I was really more interested in understanding his "economic implosion" thesis. I found his response on that point was rather unconvincing; judge for yourself:

@GeorgeKerevan

1. Shouldn't voting for you *stop* that happening?

2. Maybe reread what your statement actually says?

— Kevin Hague (@kevverage) April 27, 2015

I tried to get clarification of his position - he was asking for my vote after all;

@GeorgeKerevan

... now you say if I vote for you you'll end austerity and prevent the UK economy imploding.

Which is it?

— Kevin Hague (@kevverage) April 27, 2015

Needless to say despite a few polite nudges I've never had a response to this question. Too late now I guess, he's my MP anyway.

Which brings us to today's piece by Mr Kerevan in that august paper of record "The National" in which he states;

"We all know that in present UK economic circumstances a fiscally autonomous Scotland would face a significant budget deficit.

At least he's consistent. Of course during the campaign his more vociferous colleagues were telling us the black-hole was "made up" and nothing to be worried about. During the indyref we were told we send more to Westminster than we get back. Now we're being told that full fiscal autonomy would be "economic suicide" because of our reliance on "UK wide fiscal balancing" to fund our higher spending.For Scotland to accept fiscal autonomy without inbuilt UK-wide fiscal balancing would be tantamount to economic suicide"

I wonder why - in what is

Maybe George is afraid that a few SNP voters might notice the staggering hypocrisy in the SNP's position if he spelled it out that clearly.

Saturday, 9 May 2015

It Doesn't Matter

The SNP should be applauded for their remarkable General Election success. Those of us who criticised their campaign rhetoric and felt their economic policies were potentially hugely damaging to Scotland must take pause. What do we learn from this?

It turns out that in Scottish politics at least, quite a lot of things don't really matter.

The SNP campaigned for independence based on a series of economic claims that were demonstrably misleading at the time and have since been shown to be clearly wrong. If the SNP had won the Independence Referendum we would be starting our independent lives £8bn a year worse off (that's £1,500 for every man, woman and child in Scotland). This is no longer conjecture - it is a fact demonstrable from the Scottish Government's own published figures.

So the fact that the economic case they presented for independence has been shown to be nonsense? It doesn't matter.

John Swinney sat on the Smith Commission and signed up to the resulting agreement on behalf of the SNP. But on the day it was published he was already crying foul and stoking further grievance claiming the recommendations

Instead the SNP demanded Full Fiscal Autonomy (FFA) - before realising that their rhetoric about "sending more to Westminster than we get back" and oil being "just a bonus" would become rapidly exposed as untrue if we were to keep our own taxes and actually try and fund our own public spending.

When the IFS produced analysis showing that FFA would create an immediate £8bn black-hole in Scotland's finances the SNP - after initially dismissing the analysis as being simply "Project Fear" - proceeded to execute a spectacular reverse ferret.

They argued "it won't happen anyway" and "by the time it happens all the numbers will be different". With quite breath-taking hypocrisy they even argued "we'd have to also keep the Barnett Formula in place otherwise the Smith Commission principle of no detriment wouldn't be honoured". That's the same Smith Commission report that - in order to achieve the no detriment principle - fell so far short of the SNP's expectations. The same Smith Commission report that they dismissed, ridiculed and set fire to in a dustbin.

This is not so much wanting your cake and eating it as saying your'e going on a diet but want to keep stuffing your face with cake.

So the fact that the SNP aren't actually prepared for Scotland to economically stand on it's own feet just yet, despite all of their indyref rhetoric? It doesn't matter.

The SNP have argued it would take us time to grow and fill the fiscal gap that separation from the UK exposes and - of course - to achieve that growth we'd need more powers.

When asked how this growth will be achieved their supporters suggest a series of tax cuts (reduce Air Passenger Duty, reduce VAT on tourism, targeted tax cuts to SMEs) at the same time as arguing to increase public expenditure because they are "anti-austerity". That these measures would inevitably mean an acceleration in the rate of increase in debt at least in the short term is simply brushed over.

So the SNP - who spent the indyref complaining that the UK's debt mountain is ruinously high and a sign of Westminster's economic incompetence - now argue to increase the rate of debt growth? It doesn't matter.

How likely is it that these tax cuts would produce sufficient economic growth to off-set the tax losses? It's hard to say, but if this was such a "slam-dunk" economic strategy you might think the Tories (hardly shy of cutting taxes) would be all over it.

But let's assume it might work as an economic strategy and ask ourselves how much growth a nimble independent European country might achieve competing against the lumbering beast of the UK. Funnily enough the Scottish Government grappled with just that question when writing the independence White Paper. They offered the following;

So the fact that the SNP's claims that we could grow our way out of the black-hole caused by FFA are - on their own terms - hopelessly optimistic? It doesn't matter.

When the SNP manifesto was published the IFS (and any vaguely informed commentator who read the manifesto) noted that "the SNP's anti-austerity rhetoric does not reflect its plans". In fact The SNP's manifesto simply matched Labour's proposed tax increases and (according to the IFS) effectively matched their spending plans too.

So the fact that the SNP's actual economic policies were materially the same as those they accused of being "Red-Tories"? It doesn't matter

When the question of Independence was raised during the election Nicola Sturgeon put on her baffled face and - adopting the tone normally reserved for explaining things to a three year-old - told us that voting for the SNP wasn't a vote for Independence, it was a vote to give us a stronger voice at Westminster. That their manifesto includes a commitment to Full Fiscal Responsibility and that their written constitution commits them to pursuing Scottish Independence is not something we're meant to concern ourselves with.

So the fact that the SNP will use their voice at Westminster to pursue FFA and independence at any cost? It doesn't matter.

I've clearly been missing the point because the Scottish electorate have shown none of these things matter.

I've made the mistake of thinking that voters realise it's not enough to just want social justice, you have to be able to afford it.

I've made the mistake of thinking that voters would see through a party saying "we're anti-austerity" if they couldn't back that up with economically coherent policies.

I've made the mistake of thinking that the economic deceit attempted during the Yes campaign would be remembered and punished by the electorate.

It turns out that all that's required is to say "we hate the Tories", "they're as bad as the Tories" and "we're anti-austerity".

But. Look where we've ended up.

Put yourself in David Cameron's shiny Church's brogues for a moment:

Scotland is now represented at Westminster by a homogenous mass of grievance seeking, Tory hating SNP MP's who's declared aim in life is to make your life as difficult as possible. They also want Full Fiscal Autonomy - at least they said they did and to refuse it now would make them look exceptionally silly.

Giving Scotland Full Fiscal Autonomy means you can justify enforcing English Votes for English Laws (EVEL) which immediately boosts your effective working majority. You might need to sweeten the pill with a transitional phasing out of Barnett but as Barnett goes you gain £8bn or so to spend in the rest of the UK. Sure, you'll have to work out some stuff about fiscal constraints and borrowing limits to protect Sterling - but to all intents and purposes you can rid yourself of those troublesome jocks whilst claiming you've kept the Union together.

The fact that this would lead to even deeper public spending cuts in Scotland than we'd endure as an integral part of the UK? That surely matters.

It turns out that in Scottish politics at least, quite a lot of things don't really matter.

The SNP campaigned for independence based on a series of economic claims that were demonstrably misleading at the time and have since been shown to be clearly wrong. If the SNP had won the Independence Referendum we would be starting our independent lives £8bn a year worse off (that's £1,500 for every man, woman and child in Scotland). This is no longer conjecture - it is a fact demonstrable from the Scottish Government's own published figures.

So the fact that the economic case they presented for independence has been shown to be nonsense? It doesn't matter.

John Swinney sat on the Smith Commission and signed up to the resulting agreement on behalf of the SNP. But on the day it was published he was already crying foul and stoking further grievance claiming the recommendations

"do not reflect the full wishes of the people of Scotland [..] falls short because it could only go as far as the Westminster parties were prepared to go"Nicola Sturgeon adopted a similar tone

"it is not enough, it doesn’t live up to the vow, it doesn’t deliver a modern form of home rule"SNP councillors publicly burnt the Smith Report and - after a brief suspension - remained in their posts.

Instead the SNP demanded Full Fiscal Autonomy (FFA) - before realising that their rhetoric about "sending more to Westminster than we get back" and oil being "just a bonus" would become rapidly exposed as untrue if we were to keep our own taxes and actually try and fund our own public spending.

When the IFS produced analysis showing that FFA would create an immediate £8bn black-hole in Scotland's finances the SNP - after initially dismissing the analysis as being simply "Project Fear" - proceeded to execute a spectacular reverse ferret.

They argued "it won't happen anyway" and "by the time it happens all the numbers will be different". With quite breath-taking hypocrisy they even argued "we'd have to also keep the Barnett Formula in place otherwise the Smith Commission principle of no detriment wouldn't be honoured". That's the same Smith Commission report that - in order to achieve the no detriment principle - fell so far short of the SNP's expectations. The same Smith Commission report that they dismissed, ridiculed and set fire to in a dustbin.

This is not so much wanting your cake and eating it as saying your'e going on a diet but want to keep stuffing your face with cake.

So the fact that the SNP aren't actually prepared for Scotland to economically stand on it's own feet just yet, despite all of their indyref rhetoric? It doesn't matter.

The SNP have argued it would take us time to grow and fill the fiscal gap that separation from the UK exposes and - of course - to achieve that growth we'd need more powers.

When asked how this growth will be achieved their supporters suggest a series of tax cuts (reduce Air Passenger Duty, reduce VAT on tourism, targeted tax cuts to SMEs) at the same time as arguing to increase public expenditure because they are "anti-austerity". That these measures would inevitably mean an acceleration in the rate of increase in debt at least in the short term is simply brushed over.

So the SNP - who spent the indyref complaining that the UK's debt mountain is ruinously high and a sign of Westminster's economic incompetence - now argue to increase the rate of debt growth? It doesn't matter.

How likely is it that these tax cuts would produce sufficient economic growth to off-set the tax losses? It's hard to say, but if this was such a "slam-dunk" economic strategy you might think the Tories (hardly shy of cutting taxes) would be all over it.

But let's assume it might work as an economic strategy and ask ourselves how much growth a nimble independent European country might achieve competing against the lumbering beast of the UK. Funnily enough the Scottish Government grappled with just that question when writing the independence White Paper. They offered the following;

"If Scotland moved from the rates of growth it has experienced in the past to instead match the levels of growth of small European countries, the benefits for people in Scotland in terms of prosperity and employment would be significant. As an illustration, had growth in Scotland matched these other independent nations between 1977 and 2007, GDP per head would now be 3.8 per cent higher, equivalent to an additional £900 per head"So the SNP themselves have suggested that 3.8% higher growth over a 30 year period is a realistic growth dividend to expect from independence. Unfortunately, to close the £8bn deficit gap Scotland would require 16% higher growth than the rest of the UK. So that would take about 120 years then. During which time we would be funding the higher deficit how exactly?

So the fact that the SNP's claims that we could grow our way out of the black-hole caused by FFA are - on their own terms - hopelessly optimistic? It doesn't matter.

When the SNP manifesto was published the IFS (and any vaguely informed commentator who read the manifesto) noted that "the SNP's anti-austerity rhetoric does not reflect its plans". In fact The SNP's manifesto simply matched Labour's proposed tax increases and (according to the IFS) effectively matched their spending plans too.

So the fact that the SNP's actual economic policies were materially the same as those they accused of being "Red-Tories"? It doesn't matter

When the question of Independence was raised during the election Nicola Sturgeon put on her baffled face and - adopting the tone normally reserved for explaining things to a three year-old - told us that voting for the SNP wasn't a vote for Independence, it was a vote to give us a stronger voice at Westminster. That their manifesto includes a commitment to Full Fiscal Responsibility and that their written constitution commits them to pursuing Scottish Independence is not something we're meant to concern ourselves with.

So the fact that the SNP will use their voice at Westminster to pursue FFA and independence at any cost? It doesn't matter.

I've clearly been missing the point because the Scottish electorate have shown none of these things matter.

I've made the mistake of thinking that voters realise it's not enough to just want social justice, you have to be able to afford it.

I've made the mistake of thinking that voters would see through a party saying "we're anti-austerity" if they couldn't back that up with economically coherent policies.

I've made the mistake of thinking that the economic deceit attempted during the Yes campaign would be remembered and punished by the electorate.

It turns out that all that's required is to say "we hate the Tories", "they're as bad as the Tories" and "we're anti-austerity".

But. Look where we've ended up.

Put yourself in David Cameron's shiny Church's brogues for a moment:

Scotland is now represented at Westminster by a homogenous mass of grievance seeking, Tory hating SNP MP's who's declared aim in life is to make your life as difficult as possible. They also want Full Fiscal Autonomy - at least they said they did and to refuse it now would make them look exceptionally silly.

Giving Scotland Full Fiscal Autonomy means you can justify enforcing English Votes for English Laws (EVEL) which immediately boosts your effective working majority. You might need to sweeten the pill with a transitional phasing out of Barnett but as Barnett goes you gain £8bn or so to spend in the rest of the UK. Sure, you'll have to work out some stuff about fiscal constraints and borrowing limits to protect Sterling - but to all intents and purposes you can rid yourself of those troublesome jocks whilst claiming you've kept the Union together.

The fact that this would lead to even deeper public spending cuts in Scotland than we'd endure as an integral part of the UK? That surely matters.

Monday, 4 May 2015

Guest Blog: Neil Lovatt on N56

Guest blog written by Neil Lovatt who can be found on Twitter @neiledwardlovatt

N56 Analysis of Fiscal Autonomy: Spun for Social Media

Today we received two publications from the SNP leaning “think tank” N56, one on growth the other on Fiscal Autonomy. [KH: N56 was founded by Dan MacDonald, a board member of the pro-independence Yes Scotland organisation]

This post concerns itself with the second of these publications rather then the former. However I would say that growth strategy publication is a generic collection of good wishes such as investing in infrastructure where it has a positive value, encouraging exports and innovation as well as paying more in welfare. That’s what anyone in industry would call a “fairy dust solution” as it simply states policies that sound wonderful but actually have as much chance of failure as success.

However let me be clear: if there are obvious self funding policies that could be pursued that will help the UK or Scotland then I’m all for them, but who wouldn't be? Unfortunately the N56 growth report doesn't contain any such free and obvious policies.

But let’s turn to the Fiscal Autonomy paper.

Where’s Full?

The sharp eyed among you will have noticed that the title doesn't include the word “Full” - we might ask ourselves why. I suspect it’s because as the author worked their way through the proposal they realised that what they were proposing wasn't “Full”. In fact it isn't “Autonomous” either as I’ll demonstrate. It appears that may have led to a rewriting of the title without editing the copy correctly. See here for instance:

Full Financial (not Fiscal) Responsibility is (or at least used to be) the Scottish Government’s position as set out here. The Scottish Government don’t like to be reminded of this as it was produced by them in 2011 when they had a very different view of the Scottish public finances.

However the N56 "Fiscal Autonomy" is not "full" - it differs from DevoMax or the Scottish Government’s proposals in two very important ways.

Firstly the report assumes that fiscal transfers (pooling and sharing) will continue under the arrangement.

This doesn't explicitly mean Barnett but it’s as close to a dog whistle as you are going to get. The idea that Scotland becomes fiscally independent from the UK but they receive fiscal transfers from the UK when it ends up below some needs based formula is de facto a continuation of our current pooling and sharing arrangements with different accountancy treatment.

Also note the second paragraph about the principles to be agreed on how the proposal would work. This effectively says that the UK as a whole would need to agree on levels of spending, tax levels, benefits etc. In other words the Scottish Government would not be free to do whatever it wants, so neither “Full” nor “Autonomous” in any meaningful sense of either term.

This proposal is actually a good idea in my view, indeed I’ve been in favour of such an accountancy change whilst keeping something akin to Barnett as proposed by the Welsh Assembly (although that will still leave Scotland worse off than Barnett). However let’s be clear this is not Full Fiscal Autonomy or DevoMax - it’s Smith with the transparency of GERS put on a statutory basis.

Secondly, and quite outrageously, the N56 proposal flies in the face of the Scottish Government’s proposal for borrowing powers by arguing that borrowing should be granted to the Scottish Government but the UK should be the guarantor.

This proposal means that the Scottish Government would have the right to borrow at UK government interest rates despite having a higher credit risk (see Moodys analysis below) and have their borrowing guaranteed by the UK taxpayer.

You have to question what sane British Chancellor would accede to such a request. Allow the Scottish Government to borrow as it requires putting potential strain on the UK currency and UK interest rates on the understanding that the UK government would bail out the Scottish Government if they got into hot water?

That means that the Scottish Government will expect an explicit credit guarantee from the UK, effectively having its borrowing subsidised. Again that is neither “Full” or “Autonomous”.