Summary

Full Fact have concluded that senior SNP politicians have been guilty of making false statements to suggest that Scotland is close to self-sufficient in renewables (see here and here).

Nowadays - to avoid being accused of making blatantly false claims - the SNP are generally careful to include the qualifying phrase "the equivalent of" when making statements about the extent to which Scottish renewables meet Scotland's electricity demand. But as Full Fact have also made clear, this phraseology is still misleading:

The SNP are clearly wedded to this misleading statistic - take just three recent examples:

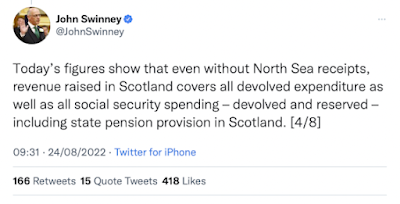

- Responding to Full Fact: "A Scottish Government Spokesperson said: Scotland has a hugely positive story to tell in renewables, which provided the equivalent of 96% of Scotland's gross electricity consumption in 2020"

- Nicola Sturgeon correcting the record in Holyrood: "Corrected text: Under this Government, the equivalent of 98.8% of our gross electricity consumption is already provided by renewable energy sources."

- Ian Blackford in Parliamentary Debate: "and nearly 100% of the equivalent of our electricity consumption already comes from renewables <interruption> ... I ... you know I've said equivalent on many occasions but I thank the right honourable gentleman for that [...] I think if the honourable gentleman checks Hansard he'll find that I've said that on a number of occassions"

As an aside: it's easy to check Hansard and in fact Ian Blackford has never used the "equivalent" qualifier in this context (see here) but he did make the false, unqualifed claim in September (see here); "almost 100% of our entire electricity production comes from renewables. That is not attention-seeking, I would say to the Prime Minister; these are the facts."

To illustrate why quoting only the "equivalent of " statistic is highly misleading, the following figures all come from the same Scottish Government source for 2020 and are internally consistent:

- Scotland was capable of meeting all of its electricity demand from renewable generation just 51.1% of the time

- 55.7% of electricity consumed in Scotland came from renewables

- The equivalent of 98.8% of Scotland's gross electricity consumption was generated by renewables [this is the figure the SNP keep quoting]

Using the same source we also know the figures for 2021 (with one caveat) and in all cases the most recent year's figures are lower:

- Scotland was capable of meeting all of its electricity demand from renewable generation just 37.8% of the time [this is the figure quoted by Full Fact above]

- 52.8% of electricity consumed in Scotland came from renewables

- The equivalent of 82.9% of Scotland's gross electricity consumption was generated by renewables [a figure which was briefly published and subsequently deleted, see below]

Looking at the figures above it's obvious why the SNP are so fond of the 2020 "equivalent of" figure. What is perhaps less obvious is how the first two measures above can be consistent with that figure. This blog seeks to clarify the confusion caused by these different measures and to explain why the first two measures give a clearer "real world" picture.

It should be clear from these figures that anybody with the impression that Scotland is close to being self-sufficient in renewables has been seriously misled.

Explaining the Figures

Scotland's First Minister was recently compelled to correct the official record following an FOI request from Sam Taylor of These Islands. The correction (found here) was as follows:

Original text: Under this Government, we have a position where our net energy consumption is already provided by renewable energy sources.

Corrected text: Under this Government, the equivalent of 98.8% of our gross electricity consumption is already provided by renewable energy sources.

The introduction of 98.8% and the switch from net to gross are distractions, the key amendment doing all the heavy lifting is the introduction of the words "the equivalent of".

To explain what's going on here we need to understand three different measures, each of which tells us something different about the extent to which Scotland's renewables energy generation matches Scotland's electricity demand

- The equivalent of gross electricity consumption met from renewables: this simply takes total renewables electricity produced through the year (including electricity exported) and divides it by total electricity consumed in Scotland in the same year; it takes no account of whether the electricity was being produced when it was needed in Scotland

- Proportion of electricity consumed from renewables: this shows how much electricity consumed in Scotland actually came from renewables. It's a far lower figure because it reflects the reality of demand vs supply variation; if Scotland needs more electricity than renewables can provide at the time it's needed then non-renewable generation is used

- Proportion of time when Scotland is capable of meeting demand from renewables: this is the harshest measure of "self-sufficiency" as it counts only those half-hour periods where Scotland's renewables generation exceeds demand.

We can look at each of these measures as shown on the Scottish Government's "Energy Statistics Hub".

Measure 1: in 2020 the equivalent of 98.8% of gross electricity consumption came from renewable sources [found here]

Measure 2: in the 12 months to September 2022, 63.1% of electricity that Scotland consumed came from renewable resources [found here]

That figure is also available for past calendar years so we can see that in 2021 it was 52.8% and in 2020 it was 55.7%

Measure 3: in 2021 Scotland was capable of meeting demand from Scottish renewables generation 37.8% of the time [found here]

- Scotland was capable of meeting all its electricity demand from renewable generation just 37.8% of the time

- 52.8% of electricity consumed in Scotland came from renewables

- The equivalent of [roughly] 82.9% of Scotland's gross electricity consumption was generated by renewables [a figure which was briefly published and subsequently deleted]

Appendix: Explaining how the measures differ

Having discussed these measures with many smart and well-informed people, it's clear that it's easy to get confused about what the different measures mean. To explain how the three different measures vary, it's helpful to illustrate with some simple theoretical examples of supply/demand matching.

Let's start with a very simple extreme example where, over a 12-period timescale, renewables always meets 50% of demand:

- Measure 1: the equivalent of 50% of electricity consumption is met by renewables

- Measure 2: 50% of electricity consumed came from renewables

- Measure 3: renewables were capable of meeting demand 0% of the time

- Measure 1: the equivalent of 50% of electricity consumption is met by renewables

- Measure 2: 50% of electricity consumed came from renewables

- Measure 3: renewables were capable of meeting demand 50% of the time

- Measure 1: the equivalent of 73% of electricity consumption is met by renewables

- Measure 2: 73% of electricity consumed came from renewables

- Measure 3: renewables were capable of meeting demand 50% of the time

- Measure 1: the equivalent of 83% of electricity consumption is met by renewables (the total green area would fill in 83% of the area under the 100% of demand line)

- Measure 2: 73% of electricity consumed came from renewables (this is the same as the previous illustration because renewables production which exceeds demand does not contribute to this figure)

- Measure 3: renewables were capable of meeting demand 50% of the time (6 out of 12 periods)

In reality, each time period would have a different absolute level of demand, so the maths gets a little more complicated - meeting demand when demand is low has less impact on measures 1 and 2 than meeting demand when demand is high (although measure 3 is unaffected by this issue). I could draw another graph, but I think we've probably gone far enough to explain the dynamics at play here.

ADDENDUM [added 04/11/2022]

The difference between "when the wind blows" and "when we need electricity" is clearly an important factor in this debate, so I went hunting for the data and found what I wanted on the National Grid Data Explorer.

The "Demand Data Update" provides actual half-hourly data for (amongst other things) National Demand and Embedded Wind Generation. That Embedded Wind Generation is not all wind generation*, but it provides us with data on variability of wind generation for the same half-hourly periods that we have data for National Demand.

Armed with this data we can create indices of electricity demand and wind generation where both average to 100. This gives us an illustrative graph where the equivalent of all demand is met by wind generation while reflecting the actual variability of that supply and demand during the month of October 2022:

******

* "This is an estimate of the GB wind generation from wind farms which do not have Transmission System metering installed. These wind farms are embedded in the distribution network and invisible to National Grid. Their effect is to suppress the electricity demand during periods of high wind. The true output of these generators is not known so an estimate is provided based on National Grid’s best model. Note that embedded wind farms which do have Transmission System metering are not included in this total."